The finals of the 1st Motilal Oswal Think Equity Think QGLP Contest was held on Monday, 2 October 2017 in the P P Gupta Auditorium with the IIM Ahmedabad Campus.

All the 13 finalist teams (listed herein) presented their stock pitches to a 3-member jury (profiled alongside). The presentations were evaluated on the following criteria –

| (1) | Quality of business |

| (2) | Quality of management |

| (3) | Growth |

| (4) | Longevity |

| (5) | Price |

| (6) | Presentation and Q&A |

It was a keenly fought contest, and the judges had to grapple with quite a few tied scores at the top of the table. Finally, the Chairman of the jury panel, Mr Raamdeo Agrawal exercised his casting vote to decide on the top 3 winners as follows –

| Winning team | : | ISB Mohali (Prize money of Rs. 5,00,000/-) |

| First Runner-up | : | IIM Rohtak (Prize money of Rs. 2,00,000/-) |

| Second Runner-up | : | IIM Bangalore (Prize money of Rs. 1,00,000/-) |

Hearty congratulations to the winning teams!

THE FINALISTS

JUDGES FOR THE CONTEST FINALS

| No. | Name of Institute |

|---|---|

| 1 | Bharatidasan Institute |

| 2 | Bharatiya Vidya Bhavan |

| 3 | BRCM College |

| 4 | Chetna Institute |

| 5 | CSIBER |

| 6 | FLAME University |

| 7 | FMS Delhi |

| 8 | FORE School of Management |

| 9 | Gogte Institute |

| 10 | Great Lakes Institute, Chennai |

| 11 | Great Lakes Institute, Gurgaon |

| 12 | Gujarat National Law University |

| 13 | IIFT |

| 14 | IIM Ahmedabad |

| 15 | IIM Bangalore |

| 16 | IIM Calcutta |

| 17 | IIM Indore (Mumbai) |

| 18 | IIM Lucknow |

| No. | Name of Institute |

|---|---|

| 19 | IIM Raipur |

| 20 | IIM Ranchi |

| 21 | IIM Rohtak |

| 22 | IIM Sambalpur |

| 23 | IIM Shillong |

| 24 | IIM Udaipur |

| 25 | IISc Bangalore |

| 26 | IIT Delhi |

| 27 | IIT Kharagpur |

| 28 | IMT Ghaziabad |

| 29 | Indira Global Business School |

| 30 | International Business School |

| 31 | International Management Institute |

| 32 | ISB Hyderabad |

| 33 | ISB Mohali |

| 34 | Jamnalal Bajaj Institute |

| 35 | KJ Somaiya Institute |

| 36 | KSR School of Management |

| No. | Name of Institute |

|---|---|

| 37 | Loyola Institute of Business Administration |

| 38 | MDI Gurgaon |

| 39 | MDI, Murshidabad |

| 40 | MIET Meerut |

| 41 | N L Dalmia Institute |

| 42 | National Academy of Agricultural Research |

| 43 | NMIMS Bangalore |

| 44 | NMIMS Mumbai |

| 45 | S P Jain Institute |

| 46 | Shriram College of Commerce |

| 47 | SIES |

| 48 | Siva Sivani Institute |

| 49 | Sri Sri University |

| 50 | Symbiosis, Bangalore |

| 51 | Symbiosis, Pune |

| 52 | United World School |

| 53 | Welingkar Institute |

| 54 | Xavier Institute of Management |

Quality of business x

Quality of management

Growth in earnings

Longevity — of both Q & G

Price

At Motilal Oswal AMC, we have applied QGLP in a disciplined fashion. It is reflected in healthy alpha across our products.

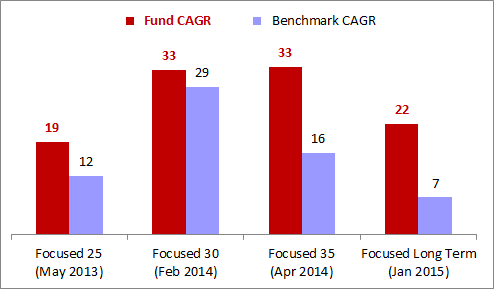

Returns since inception: Mutual Funds

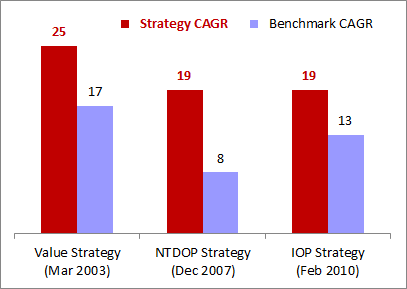

Returns since inception: PMS

Mutual Funds

Portfolio Management Services