Systematic Investment Plan (SIP)?

No matter how big your financial goal is, it can be achieved with even a small amount if given the right amount of time with a systematic investment plan in Mutual Funds.

Systematic Investment Plan (SIP)?

A Systematic Investment Plan Or SIP is a smart and hassle free mode for investing money in mutual funds. It helps you to create wealth, by investing small sums of money at specified intervals, over a period of time instead of a heavy one-time investment.

A SIP is a planned approach towards investments and helps you inculcate the habit of saving and building wealth by investing an amount as low as Rs. 500 monthly. investing at an early stage of life lets you enjoy the benefits of two powerful strategies, rupee cost averaging and the power of compounding.

SIP allows you to buy units on a specified date every month, so that you can implement a saving plan for yourself. The benefits of this can be enjoyed as and when the need arises for occasion, buying a house or a car etc. and above all, retirement.

Benefits of SIP

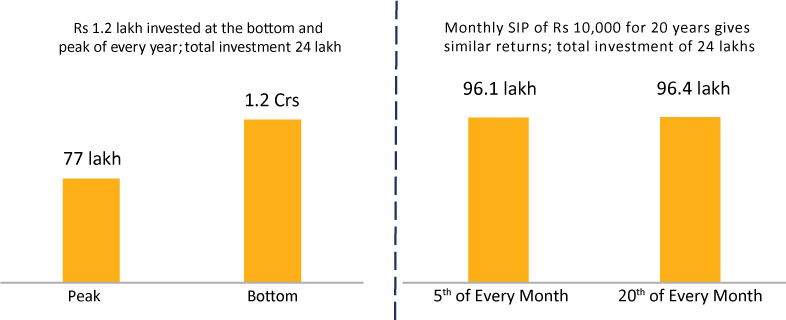

It’s the key to investing success. Regular investment makes you disciplined in your savings and also leads to wealth accumulation. Systematic investing is a time-tested discipline that makes it easy to invest automatically. Investing regularly in small amounts can often lead to better results than investing in a lump sum.

Source: MOAMC internal research. Disclaimer: The above graph is an illustration of a stated example and not actual performance of any scheme. the above is for representation purpose only and should not used for development or implementation of an investment strategy. Past performance may or may not be sustained in future.

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Lumpsum | |

|---|---|---|---|---|---|---|

| Amount | 10,000 | 10,000 | 10,000 | 10,000 | 10,000 | 50,000 |

| Nav | 25 | 20 | 22 | 24 | 27 | 25 |

| Units | 400 | 500 | 455 | 417 | 370 | 2000 |

| Cumulative Units | 400 | 900 | 1355 | 1771 | 2142 | 2000 |

| Average Cost | NA | 22.5 | 22.3 | 22.8 | 23.6 | 25 |

Source: MOAMC internal research. Disclaimer: The above table is an illustration of a stated example and not actual performance of any scheme. the above is for representation purpose only and should not used for development or implementation of an investment strategy. Past performance may or may not be sustained in future.

Linear increase in the number of years invested, exponential increase in wealth generated

| Year | Rate | |||||

|---|---|---|---|---|---|---|

| 10% | 15% | 20% | 25% | 30% | 40% | |

| 3 | 1.3 | 1.5 | 1.7 | 2.0 | 2.2 | 2.7 |

| 5 | 1.6 | 2 | 2.5 | 3.1 | 3.7 | 5.4 |

| 10 | 2.6 | 4 | 6.2 | 9.3 | 14 | 29 |

| 15 | 4.2 | 8.1 | 15 | 28 | 51 | 156 |

| 20 | 6.7 | 16 | 38 | 87 | 190 | 837 |

| 25 | 11 | 33 | 95 | 265 | 706 | 4,500 |

| 30 | 17 | 66 | 237 | 808 | 2,620 | 24,201 |

The difference between 10 and 30 years is not 3x, but 16.5x!

The difference between 10 and 30 years is not 3x, but 87x!

Source: MOAMC internal research. Lumpsum investment growth over years with different rates of interest. Disclaimer: The above table is an illustration of a stated example and not actual performance of any scheme. the above is for representation purpose only and should not used for development or implementation of an investment strategy. Past performance may or may not be sustained in future.

Benefits of starting early

| SIP in Sensex | Early Starter | Late Starter | Early Starter | Late Starter |

|---|---|---|---|---|

| Amount Invested | 10,000 | 20,000 | 10,000 | 20,000 |

| Date of Investment | 1-Jan-00 | 1-Jan-10 | 1-Jan-1990 | 1-Jan-2005 |

| No. SIP Instalments | 247 | 127 | 367 | 187 |

| Total Amount Invested | 25 lakhs | 25 lakhs | 37 lakhs | 37 lakhs |

| Value of Investment (as on 1-Aug-20) | 91.6 Lakhs | 37.3 Lakhs | 272 Lakhs | 75 Lakhs |

| XIRR | 11.4% | 7.0% | 11.0% | 8.3% |

| Cost of Delay | 54.3 Lakhs | 197 Lakhs | ||

Source: MOAMC internal research. Disclaimer: The above table is an illustration of a stated example and is the actual performance of Sensex. The above is for representation purpose only and should not used for development or implementation of an investment strategy. Past performance may or may not be sustained in future.

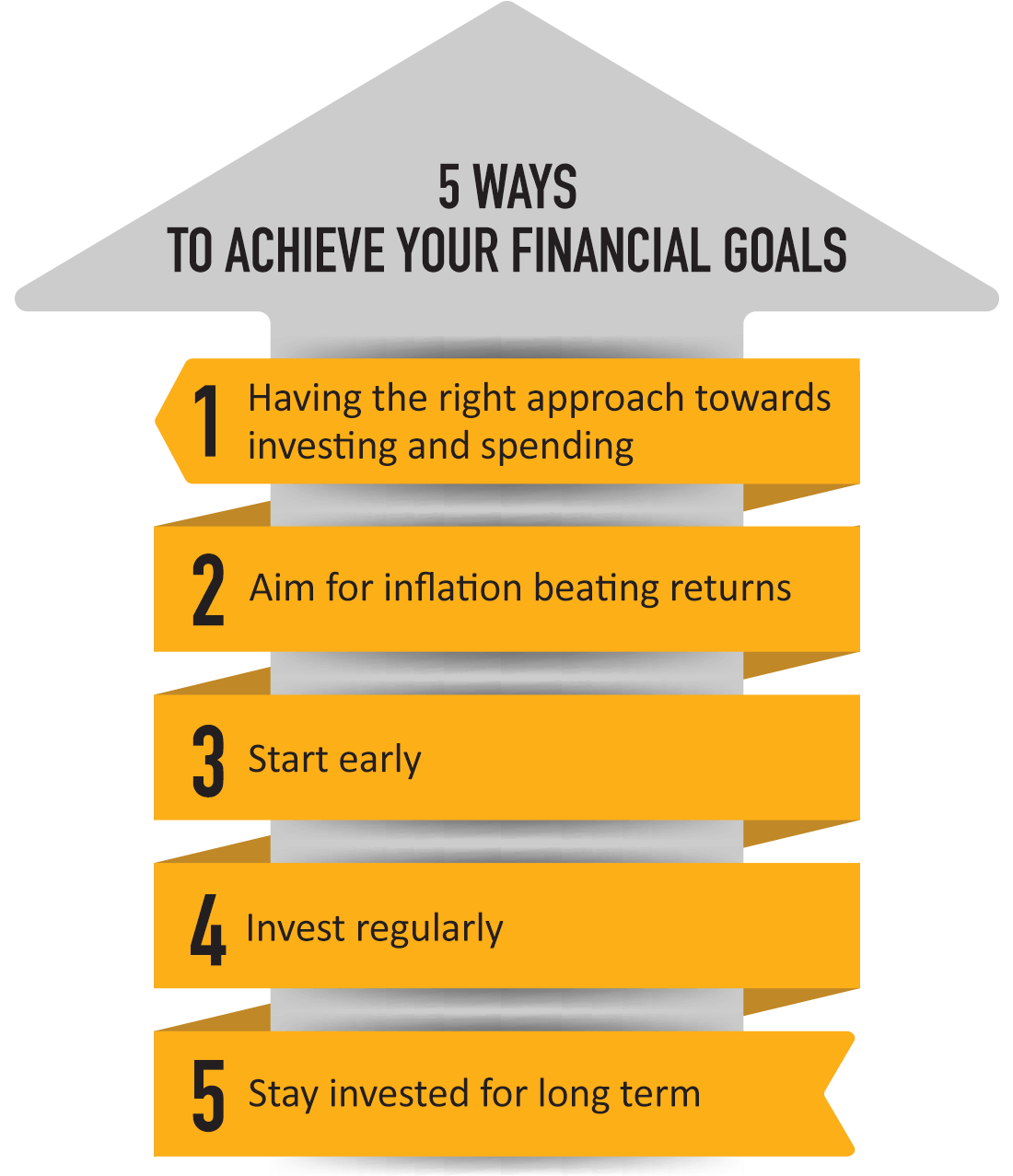

5 ways to achieve your financial goals

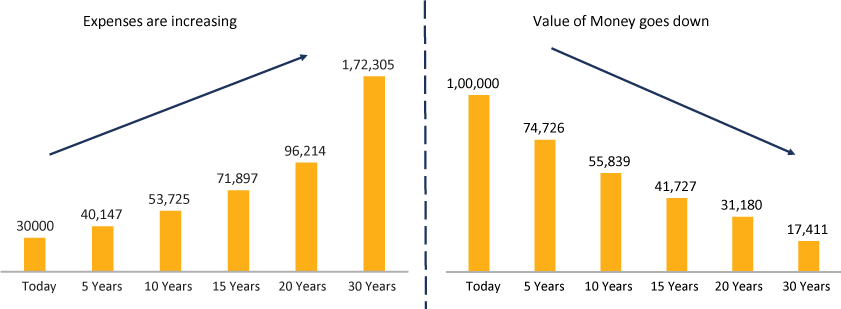

Be aware of inflation as inflation erodes wealth and purchasing power silently

Source: Internal MOAMC Research. Inflation rate assumed at 6% Disclaimer: The above graph is an illustration of a stated example and not actual performance of any scheme. the above is for representation purpose only and should not used for development or implementation of an investment strategy. Past performance may or may not be sustained in future. * Over periods of time -