Two aspects of Quality

-

-

- Sound business strategy)

- Excellence in execution

- Rational dividend payout policy

-

- Honest and transparent

- Concern for all stakeholders

-

- Long-range profit outlook

- Efficient capital allocation including growth by acquisitions

-

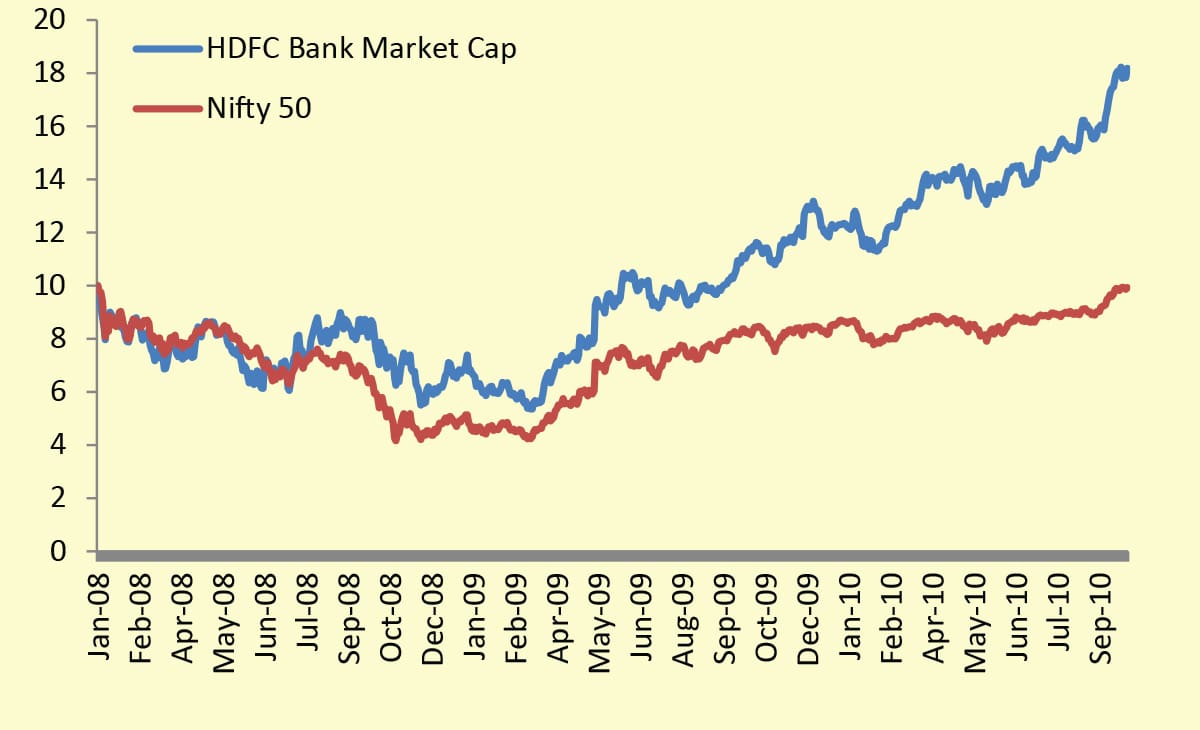

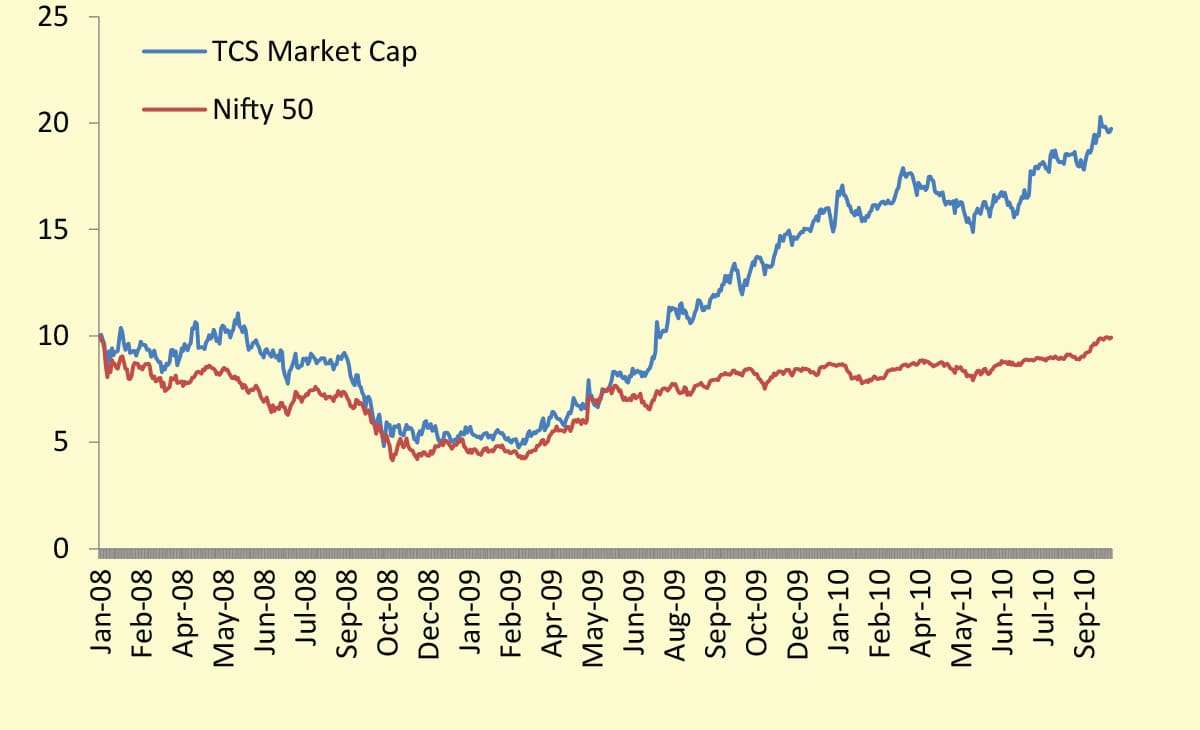

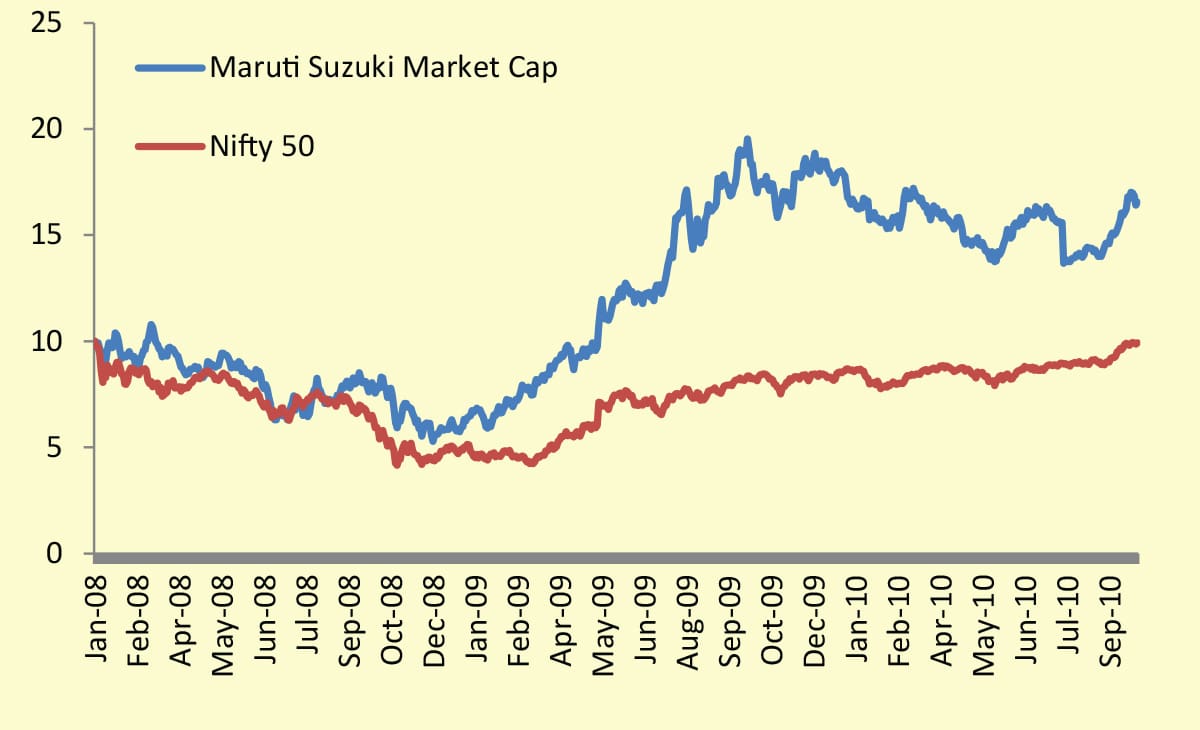

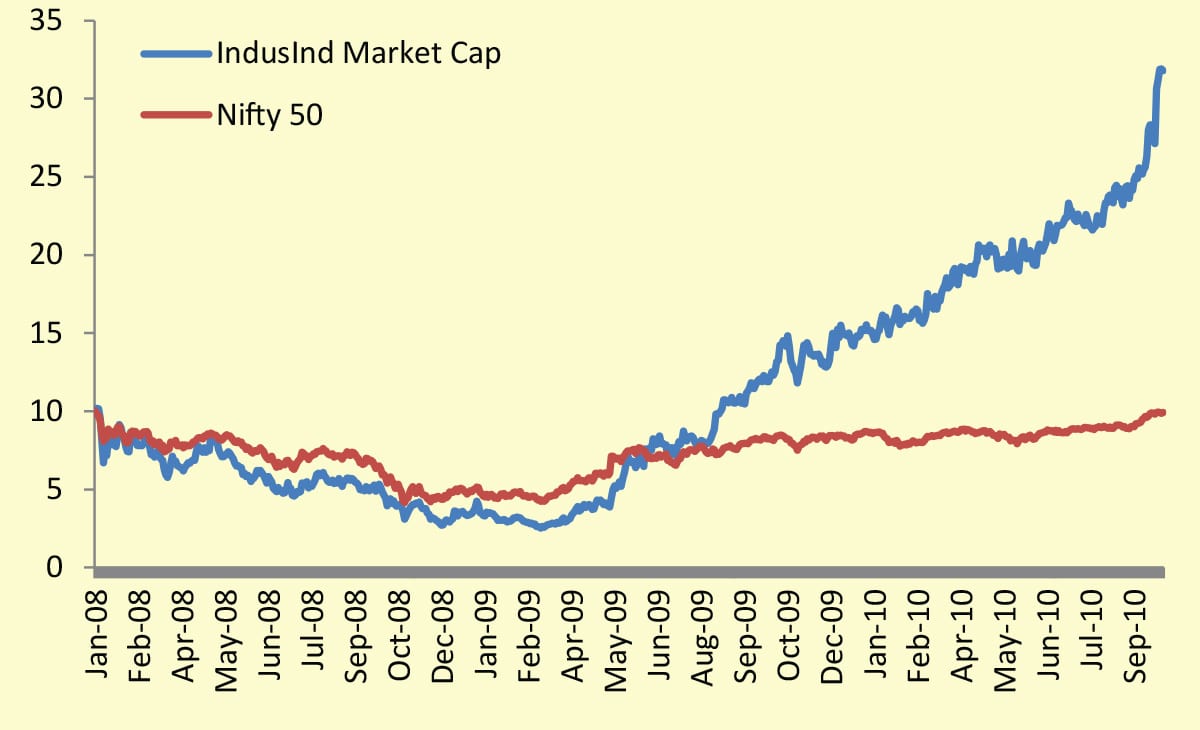

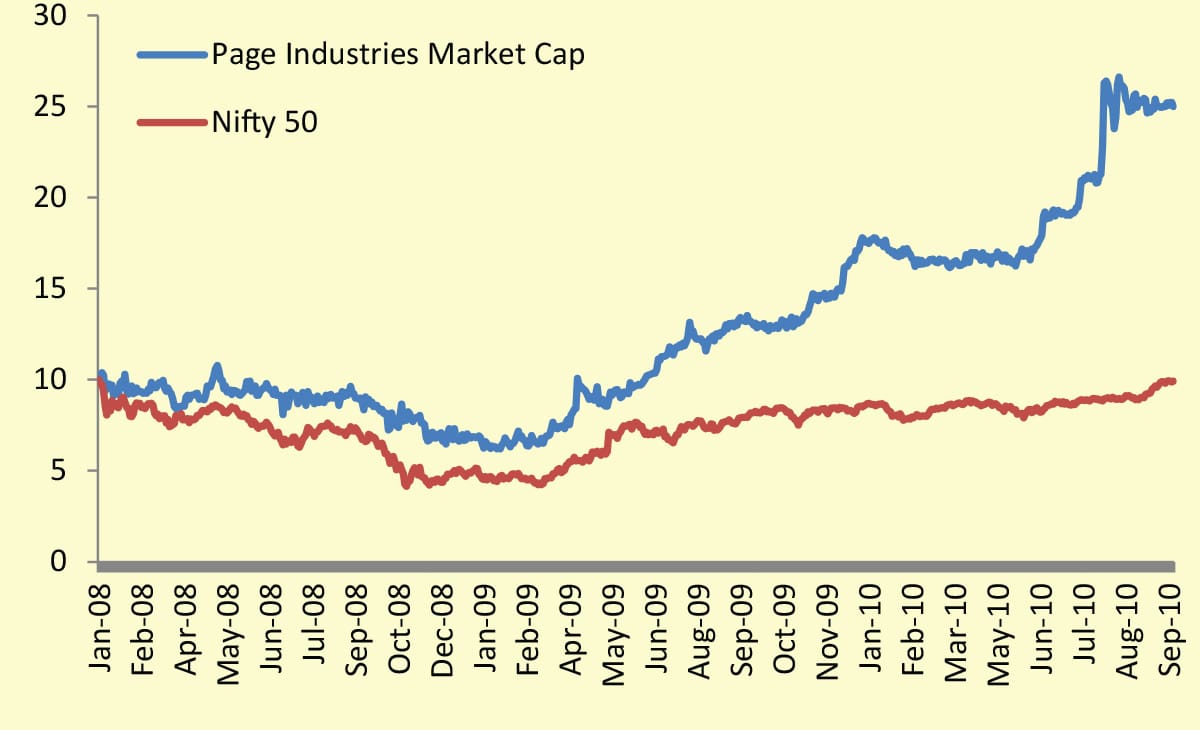

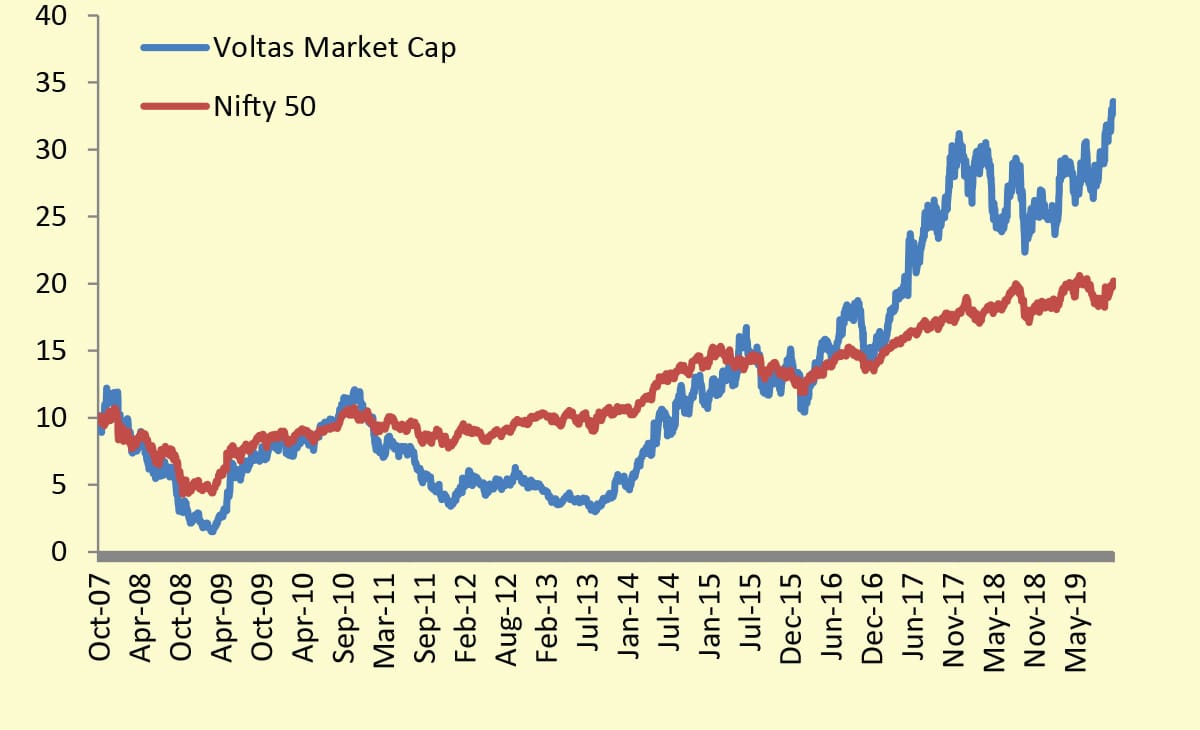

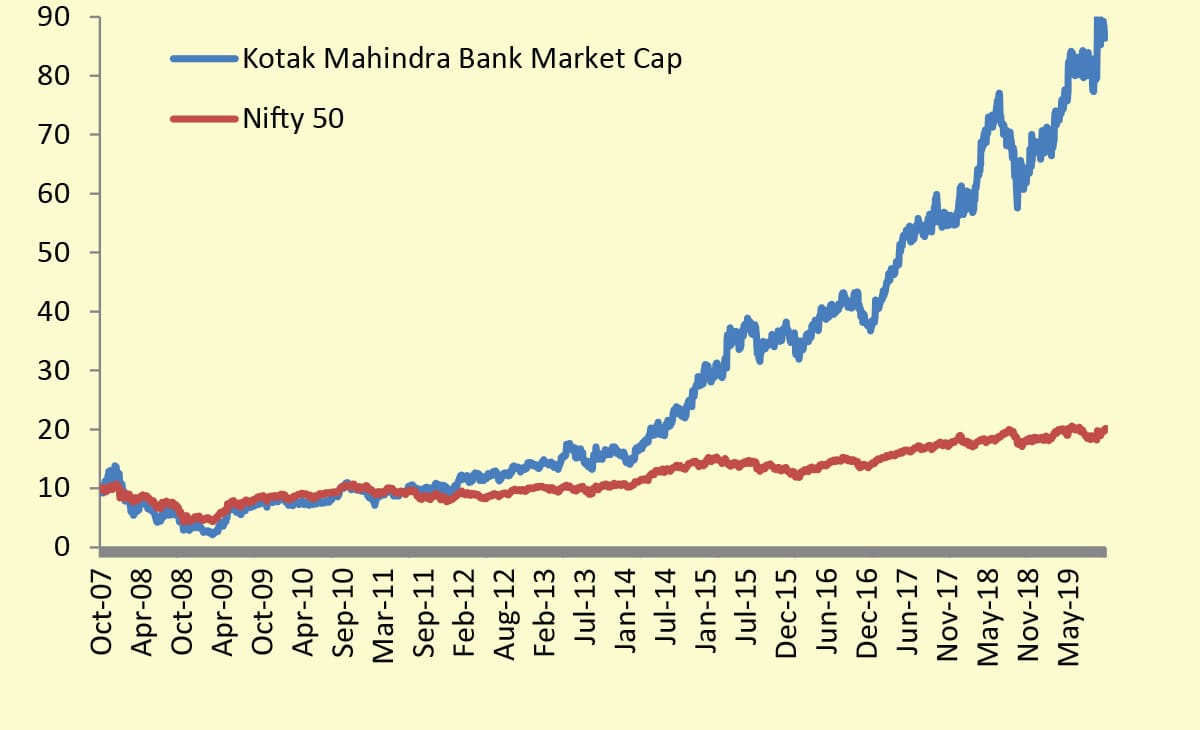

Quality Stocks always bounce back stronger than the market

Data as on 30th September, 2019 Source : MOAMC Internal Research Past performance may or may not be sustained in future.

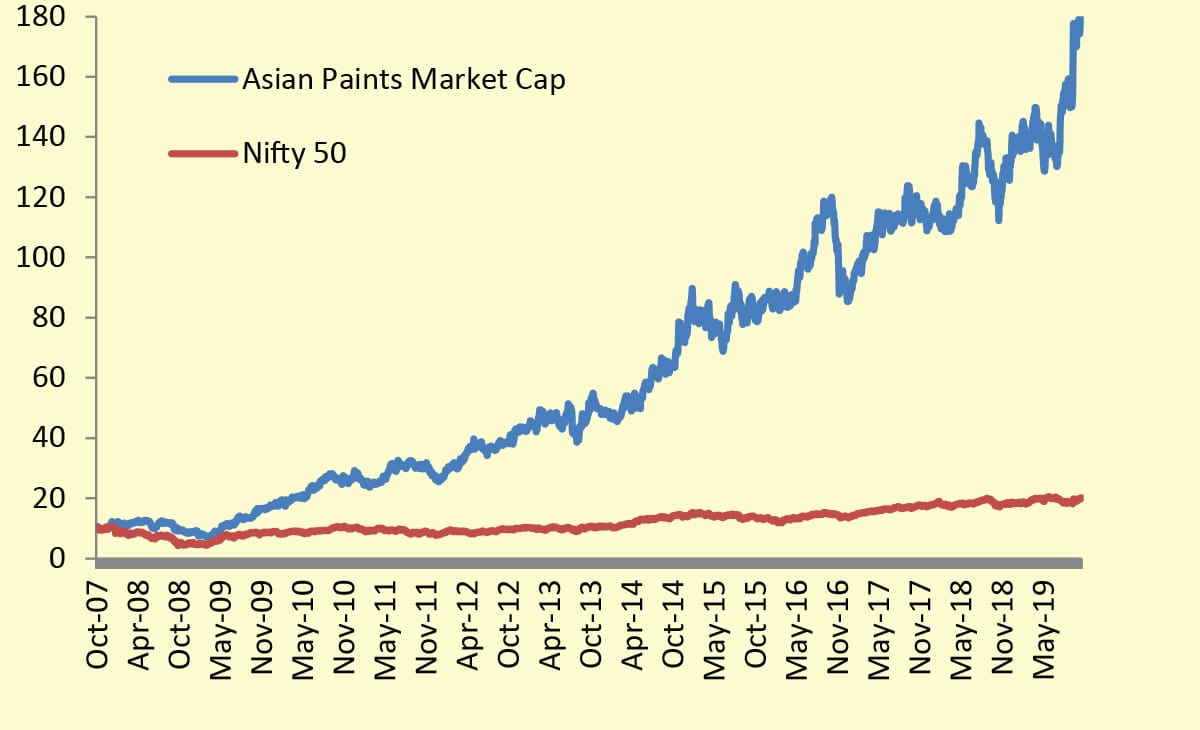

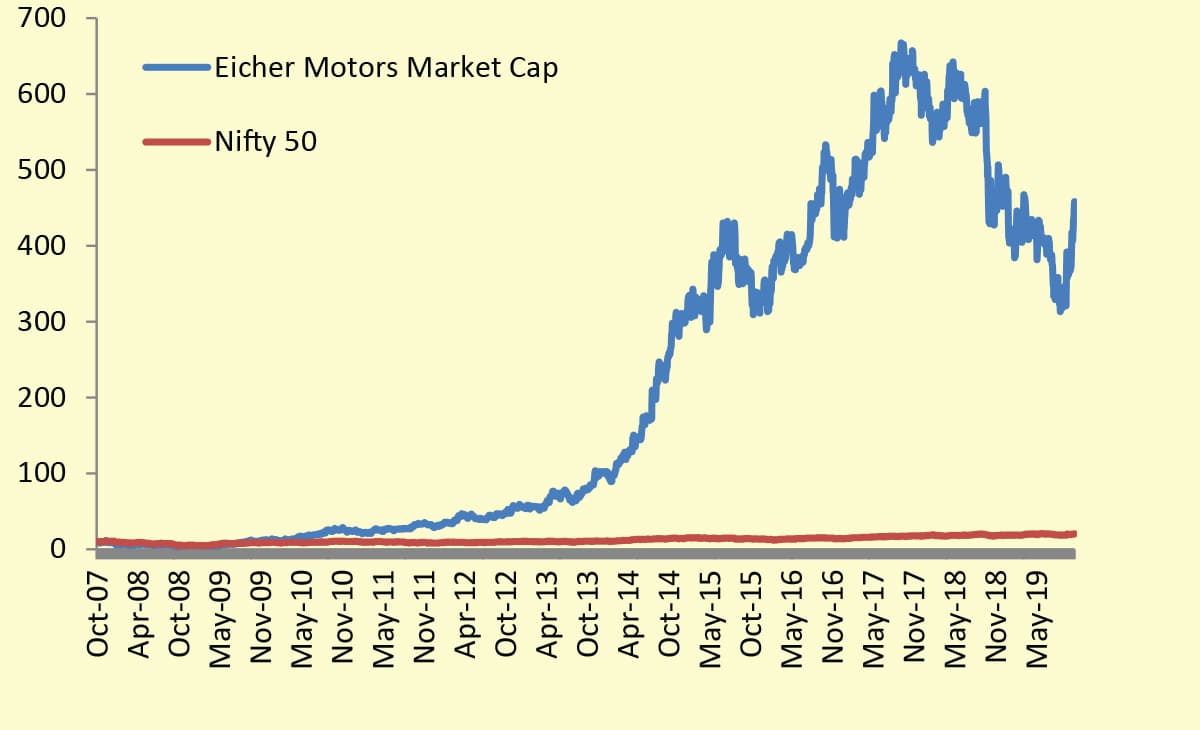

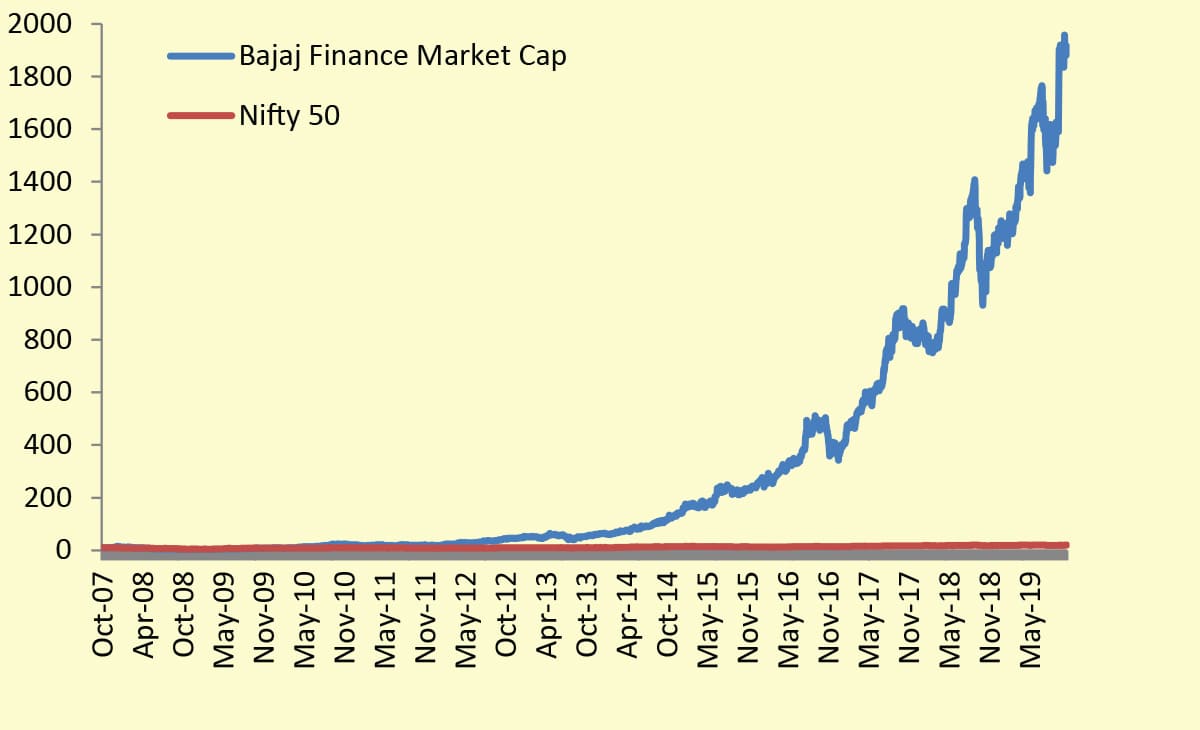

Quality stock outperform the market with huge margin

Data as on 30th September, 2019 Source : MOAMC Internal Research Past performance may or may not be sustained in future.

PERFORMANCE

| 1 Year | 3 Years | 5 Years | Since Inception | |||||

|---|---|---|---|---|---|---|---|---|

| CAGR (%) | Current Value of Investment of Rs 10000 | CAGR (%) | Current Value of Investment of Rs 10000 | CAGR (%) | Current Value of Investment of Rs 10000 | CAGR (%) | Current Value of Investment of Rs 10000 | |

| Motilal Oswal Focused 25 Fund | 23.00 | 12,299.50 | 10.36 | 13,440.80 | 10.70 | 16,624.48 | 14.33 | 23,791.30 |

| Nifty 50(Benchmark TRI*) | 15.93 | 11,592.72 | 12.75 | 14,333.36 | 8.76 | 15,218.30 | 12.67 | 21,635.91 |

| Sensex(Additional Benchmark TRI*) | 17.97 | 11,797.06 | 14.24 | 14,909.26 | 8.99 | 15,380.40 | 13.25 | 22,372.74 |

| NAV (Rs.) Per Unit (23.7913 as on 31-Oct-2019) | 19.3433 | 17.7008 | 14.3110 | 10.0000 | ||||

Date of inception : 13-May-2013 Incase, the start/end date of the concerned period is non business date (NBD), the NAV of the previous date is considered for computation of returns. The NAV per unit shown in the table is as on the start date of the said period. Past performance may or may not be sustained in the future.Performance is for Regular Plan Growth option. Different plans have different expense structure. Mr. Siddharth Bothra is the Fund Manager for equity component since 23-Nov-2016 and Mr. Abhiroop Mukherjee is the Fund Manager for debt component since inception To know the performance of the Schemes managed by same Fund Managers click here. Data as on 31-Oct-2019 |

||||||||

| 1 Year | 3 Years | 5 Years | Since Inception | |||||

|---|---|---|---|---|---|---|---|---|

| CAGR (%) | Current Value of Investment of Rs 10000 | CAGR (%) | Current Value of Investment of Rs 10000 | CAGR (%) | Current Value of Investment of Rs 10000 | CAGR (%) | Current Value of Investment of Rs 10000 | |

| Motilal Oswal Midcap 30 Fund | 12.99 | 11,299.02 | 3.33 | 11,033.71 | 10.99 | 16,839.54 | 18.59 | 26,362.30 |

| Nifty Midcap 100 TRI Index (Benchmark) | -1.17 | 9,882.58 | 2.99 | 10,923.60 | 8.44 | 14,993.92 | 16.03 | 23,290.09 |

| Nifty 50(Additional Benchmark TRI*) | 15.93 | 11,592.72 | 12.75 | 14,333.36 | 8.76 | 15,218.30 | 13.63 | 20,679.87 |

| NAV (Rs.) Per Unit (26.3623 as on 31-Oct-2019) | 23.3315 | 23.8925 | 15.6550 | 10.0000 | ||||

Date of inception : 24-Feb-2014 Incase, the start/end date of the concerned period is non business date (NBD), the NAV of the previous date is considered for computation of returns. The NAV per unit shown in the table is as on the start date of the said period. Past performance may or may not be sustained in the future. Performance is for Regular Plan Growth option. Different plans have different expense structure. = Mr. Akash Singhania is the Fund Manager for equity component since 28-Jul-2017; Mr. Niket Shah is the Associate Fund Manager since March 1, 2018 and Mr. Abhiroop Mukherjee is the Fund Manager for debt component since 24-Feb-2014. To know the performance of the Schemes managed by same Fund Managers click here. Data as on 31-Oct-2019 |

||||||||

| 1 Year | 3 Years | 5 Years | Since Inception | |||||

|---|---|---|---|---|---|---|---|---|

| CAGR (%) | Current Value of Investment of Rs 10000 | CAGR (%) | Current Value of Investment of Rs 10000 | CAGR (%) | Current Value of Investment of Rs 10000 | CAGR (%) | Current Value of Investment of Rs 10000 | |

| Motilal Oswal Multicap 35 Fund | 16.52 | 11,652.15 | 9.37 | 13,081.39 | 14.19 | 19,419.31 | 19.89 | 27,184.70 |

| Nifty 500(Benchmark TRI*) | 12.10 | 11,210.10 | 10.29 | 13,414.72 | 8.99 | 15,378.74 | 12.86 | 19,479.58 |

| Nifty 50(Additional Benchmark TRI*) | 15.93 | 11,592.72 | 12.75 | 14,333.36 | 8.76 | 15,218.30 | 12.25 | 18,908.75 |

| NAV (Rs.) Per Unit (27.1847 as on 31-Oct-2019) | 23.3302 | 20.7812 | 13.9988 | 10.0000 | ||||

Date of inception : 28-Apr-2014 Incase, the start/end date of the concerned period is non business date (NBD), the NAV of the previous date is considered for computation of returns. The NAV per unit shown in the table is as on the start date of the said period. Past performance may or may not be sustained in the future. Performance is for Regular Plan Growth option. Different plans have different expense structure.=Mr. Akash Singhania has been appointed as the Fund Manager for equity component with effect from 17-May-2019 vide addendum dated 16-May-2019; Mr. Abhiroop Mukherjee is the Fund Manager for debt component since 28-Apr-2014 and Mr. Herin Visaria for Foreign Securities since 2 -July-2019. To know the performance of the Schemes managed by same Fund Managersclick here. Data as on 31-Oct-2019 |

||||||||

| 1 Year | 3 Years | Since Inception | ||||

|---|---|---|---|---|---|---|

| CAGR (%) | Current Value of Investment of Rs 10000 | CAGR (%) | Current Value of Investment of Rs 10000 | CAGR (%) | Current Value of Investment of Rs 10000 | |

| Motilal Oswal Long Term Equity Fund | 17.67 | 11,766.97 | 11.07 | 13,700.55 | 13.73 | 18,495.20 |

| Nifty 500(Benchmark TRI*) | 12.10 | 11,210.10 | 10.29 | 13,414.72 | 8.05 | 14,477.65 |

| Nifty 50(Additional Benchmark TRI*) | 15.93 | 11,592.72 | 12.75 | 14,333.36 | 8.09 | 14,502.88 |

| NAV (Rs.) Per Unit (18.4952 as on 31-Oct-2019) | 15.7179 | 13.4996 | 10.0000 | |||

Date of inception : 21-Jan-2015 Incase, the start/end date of the concerned period is non business date (NBD), the NAV of the previous date is considered for computation of returns. The NAV per unit shown in the table is as on the start date of the said period. =Past performance may or may not be sustained in the future. Performance is for Regular Plan Growth Option. Different plans have different expense structure. =Mr. Aditya Khemani has been appointed as the Fund Manager for equity component with effect from 6-Sept-2019 vide addendum dated 5-Sept-2019; = Mr. Abhiroop Mukherjee is the Fund Manager for debt component since inception. To know the performance of the Schemes managed by same Fund Managers click here. Data as on 31-Oct-2019 |

||||||

| |

1 Year | Since Inception | ||

|---|---|---|---|---|

| CAGR (%) | Current Value of Investment of Rs 10000 | CAGR (%) | Current Value of Investment of Rs 10000 | |

| Motilal Oswal Dynamic Fund | 3.78 | 10378 | 8.36 | 12477 |

| CRISIL Hybrid 35+65 – Aggressive index | 9.63 | 10963 | 10.15 | 13055 |

| Nifty 50 (Additional benchmark) | 11.39 | 11139 | 13.03 | 14014 |

| NAV (Rs.) Per Unit ( 12.4766 : as on 30-June-2019) | 12.0222 | 10.0000 | ||

Date of inception: 27-Sep-2016. Incase, the start/end date of the concerned period is non business date (NBD), the NAV of the previous date is considered for computation of returns. The NAV per unit shown in the table is as on the start date of the said period. Past performance may or may not be sustained in the future. Performance is for Regular Plan Growth Option. Different plans have different expense structure. Mr. Akash Singhania has been appointed as the Fund Manager for equity component with effect from 17-May-2019 vide addendum dated 16-May-2019; Mr. Abhiroop Mukherjee is the Fund Manager for debt component since inception. To know the performance of the Schemes managed by same Fund Managers click here. Data as on 30-June-2019 |

||||

| Name of the Scheme | This product is suitable for investors who are seeking* | |

| Motilal Oswal Focused 25 Fund (MOF25) | ● Return by investing in upto 25 companies with long term sustainable competitive advantage and growth potential ● Investment in Equity and equity related instruments subject to overall limit of 25 companies |

|

| Motilal Oswal Midcap 30 Fund (MOF30) | ● Long-term capital growth ● Investment in equity and equity related instruments in a maximum of 30 quality mid-cap companies having long-term competitive advantages and potential for growth |

|

| Motilal Oswal Multicap 35 Fund (MOF35) | ● Long-term capital growth ● Investment in a maximum of 35 equity and equity related instruments across sectors and market capitalization levels. |

|

| Motilal Oswal Long Term Equity Fund (MOFLTE) | ● Long-term capital growth ● Investment predominantly in equity and equity related instruments |

|

| Motilal Oswal Dynamic Fund (MOFDYNAMIC) | ● Long term capital appreciation ● Investment in equity, derivatives and debt instruments |

|

| Motilal Oswal Equity Hybrid Fund (MOFEH) | ● Long term capital appreciation by

generating equity linked returns ● Investment predominantly in equity and equity related instruments |

|

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

HDFC Bank delivered

HDFC Bank delivered