Blog

What Is SIP Calculator and How Does It Work?

Do you ever wish you could predict the future, especially when it comes to your finances? Well, a Systematic Investment...

Read moreWhat Is Mid Cap Funds: Meaning, Benefits, Returns and Risks

If you’ve ever doubted the popularity of mutual funds, simply look at the sheer volume of content that exists on...

Read moreWhat is a Focused Equity Fund: Meaning, Types and Benefits

In the past few years, mutual funds have grown tremendously. The assets under management have increased fivefold in the last...

Read moreLearn How to Calculate Compound Interest

Imagine this: You diligently save and invest your hard-earned money, confident that it will eventually grow over time. But here's...

Read moreDistinguish between Multi-Cap & Flexi Cap Funds

Have you ever been caught in a heavy downpour without an umbrella? That's exactly how it feels when you invest...

Read moreExchange-Traded Fund (ETF): An Essential Guide for Beginner

Did you know that according to a report by Mirae, the ETF market's AUM globally rose to $82 billion in...

Read moreUnlocking the Significance of Liquidity in Financial Planning

What is Liquidity? Liquidity plays a vital role in financial planning and investment decision-making. In this listicle article, we will...

Read moreUnderstanding CAGR: A Concise Guide to Mutual Fund Returns

CAGR – Compounded Annual Growth Rate Compound Annual Growth Rate (CAGR) is a vital metric for evaluating the performance of...

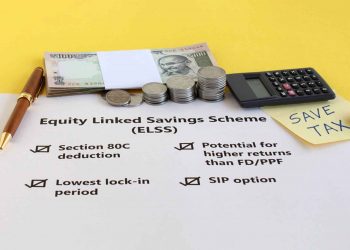

Read moreELSS Mutual Fund: A Comprehensive Guide to Tax Saving Funds

ELSS (Equity-linked Savings Scheme) Mutual Funds are a popular investment option in India that offer dual benefits of tax-saving and...

Read moreSIP Goal Calculator: Achieve Your Financial Dreams with Smart Planning

Are you ready to take charge of your financial future and make your dreams a reality? With the right tools...

Read more