Offers the benefit under 80C of Income Tax Act

Save upto Rs. 46,800* in taxes by investing in ELSS funds

Investing through ELSS helps investor build wealth by systematic investing in equity markets

QGLP framework aims at building a robust portfolio

Investors can do efficient tax planning by allocating a small amount every month through systematic investment plan or SIP

* Considering 4% educational cess on tax. Including cess, the tax saving per annum would amount to 31.2% of Rs. 1.5 Lakh or Rs. 46,800

| PPF | NSC | Bank Deposits | ELSS | |

|---|---|---|---|---|

| Lock-in | 15 years | 5 or 10 years | 5 years | 3 years |

| Returns | 7.1% | 6.8% | 4% to 6% | Market Linked |

| Tax on returns | Tax free | Taxable | Taxable | Taxable* |

* Long term capital gains applicable. Data as on December 31, 2021. The above graph is used to explain the concept and is for illustration purpose only and should not used for development or implementation of an investment strategy. Past performance may or may not be sustained in future.

| Particulars | Without Tax Saving Investments | With Tax Saving Investments |

|---|---|---|

| Gross Total Income | 17,50,000 | 17,50,000 |

| Exemption u/s 80C of the Income Tax Act, 1961 | Nil | 1,50,000 |

| Total Income | 17,50,000 | 16,00,000 |

| Tax on Total Income | 364,000 | 317,200 |

| Tax saved | Nil | 46,800 |

*(Calculation based on the current tax slab applicable in the current financial year 2021-22).

Illustration of Tax exemption for an individual less than 60 years in receipt of salary income for the assessment year 2020-21. Along with the tax deductions, an ELSS offers you the opportunity to grow your money by investing in the equity market. Long-term capital gains from these funds are tax free in your hands and the lock-in period is only 3 years Furthermore, you can also opt for a Dividend Payout option, thereby realizing some potential gain during the lock-in period, and also choose to invest through a Systematic Investment Plan and bring discipline to your tax planning.

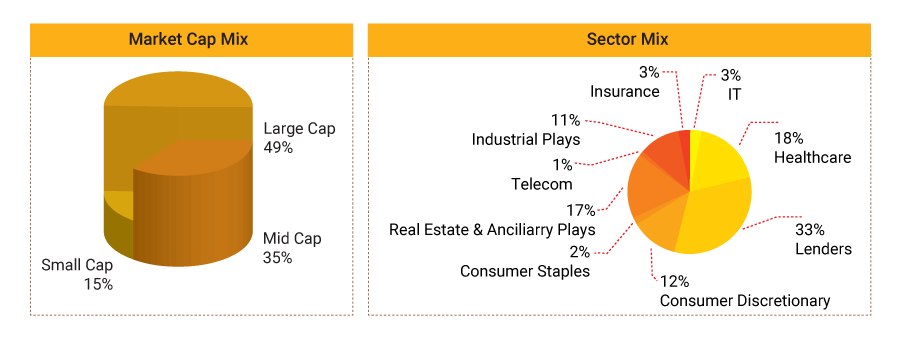

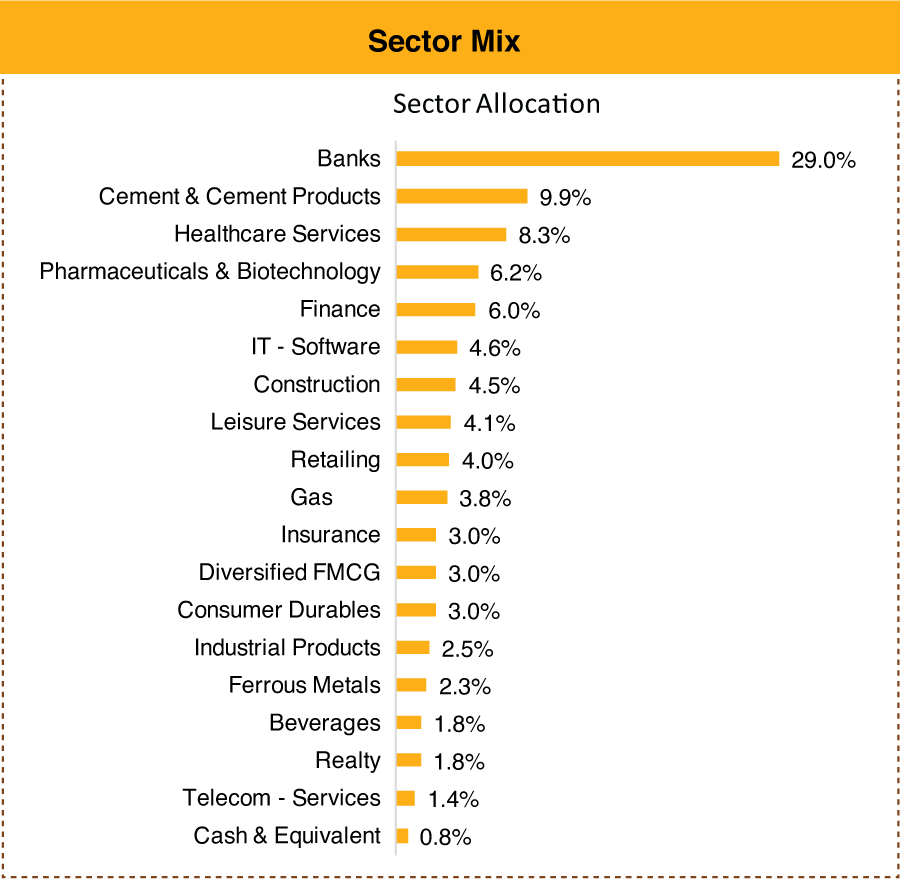

Data as on July 31, 2022. Source: MOAMC Internal Analysis The stocks mentioned above are used to explain the concept and is for illustration purpose only and should not be used for development or implementation of any investment strategy. It should not be construed as investment advice to any party. The stocks may or may not be part of our portfolio/strategy/ schemes.

Data as on July 31, 2022. Source: MOAMC Internal Research

The sector mentioned herein are for general assesment purpose only and not a complete disclosure of every material fact. It should not be construed as investment advice to any party. Past performance may or may not be sustained in future.

Data as on July 31, 2022. Source: MOAMC Internal Research

Data as on July 31, 2022. Sector classification as per AMFI defined sectors.

The Stocks/Sectors mentioned above are used to explain the concept and is for illustration purpose only and should not be used for development or implementation of any investment strategy. It should

not be construed as investment advice to any party. The stocks may or may not be part of our portfolio/strategy/ schemes. Past performance may or may not be sustained in future

| Point to Point Returns (%) | 1 Year | 3 Years | 5 Years | Since Inception | ||||

|---|---|---|---|---|---|---|---|---|

| CAGR (%) | Rs. 10000 | CAGR (%) | Rs. 10000 | CAGR (%) | Rs. 10000 | CAGR (%) | Rs. 10000 | |

| Motilal Oswal Long Term Equity Fund (LTE) | -0.8 | 9,920 | 16.1 | 15,645 | 8.6 | 15,106 | 13.2 | 25,439 |

| Nifty 500 TRI (Benchmark) | 8.7 | 10,863 | 18.8 | 16,771 | 12.1 | 17,666 | 11.4 | 22,582 |

| Nifty 50 TRI (Additional Benchmark) | 10.3 | 11,024 | 17.0 | 16,000 | 12.6 | 18,116 | 10.8 | 21,634 |

| NAV (Rs.) Per Unit (25.4394 : as on 31-July-2022) | 25.6445 | 16.2600 | 16.8409 | 10.0000 | ||||

Data as on July 31, 2022. BM = Benchmark i.e. Nifty 500 TRI Index; Add. BM = additional BM i.e. Nifty 50 TRI Index;

Date of inception: 21-Jan-15. Incase, the start/end date of the concerned period is non business date (NBD), the NAV of the previous date is considered for computation of returns. Past performance may or may not be sustained in the future. Performance is for Regular Plan Growth option. Different plans have different expense structure. Mr. Aditya Khemani is the Fund Manager for equity component since 6-Sep-2019 and Mr. Abhiroop Mukherjee is the Fund Manager for debt component since inception.

For Performance of other schemes managed by the fund managers, kindly refer to factsheet: https://www.motilaloswalmf.com/downloads/mutual-fund/Factsheet

| Name of Fund Manager: Abhiroop Mukherjee | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Period | Inception Date | 1 year | 3 year | 5 year | Since Inception | ||||

| Scheme Return (%) | Benchmark Return (%) | Scheme Return (%) | Benchmark Return (%) | Scheme Return (%) | Benchmark Return (%) | Scheme Return (%) | Benchmark Return (%) | ||

| Motilal Oswal Midcap 30 Fund | 24-02-2014 | 25.0 | 7.7 | 27.0 | 25.9 | 13.0 | 13.5 | 20.1 | 20.8 |

| Motilal Oswal Asset Allocation Passive Fund of Fund - Aggressive | 12-03-2021 | 4.2 | 6.1 | - | - | - | - | 9.1 | 11.3 |

| Motilal Oswal Liquid Fund | 20-12-2018 | 3.4 | 3.9 | 3.5 | 4.2 | - | - | 3.9 | 4.7 |

| Motilal Oswal S&P 500 Index Fund | 28-04-2020 | -2.0 | -0.3 | - | - | - | - | 17.8 | 20.4 |

| Motilal Oswal Flexi Cap Fund | 28-04-2014 | -6.7 | 8.7 | 9.2 | 18.8 | 4.8 | 12.1 | 15.1 | 14.4 |

Note:

Source/Disclaimer: MOAMC, Data as of 31-July-22. Past performance may or may not be sustained in the future. Performance is for Regular Plan Growth Option. Different plans have different expense structure.

| Name of Fund Manager: Aditya Khemani | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Period | Inception Date | 1 year | 3 year | 5 year | Since Inception | ||||

| Scheme Return (%) | Benchmark Return (%) | Scheme Return (%) | Benchmark Return (%) | Scheme Return (%) | Benchmark Return (%) | Scheme Return (%) | Benchmark Return (%) | ||

| Motilal Oswal Large and Midcap Fund | 17-10-2019 | -0.4 | 8.9 | - | - | - | - | 17.5 | 21.9 |

Note:

Source/Disclaimer: MOAMC, Data as of 31-July-22. Past performance may or may not be sustained in the future. Performance is for Regular Plan Growth Option. Different plans have different expense structure.

| Scheme name | Motilal Oswal Long Term Equity Fund | ||||||||||||

| Type of the Scheme | An open ended equity linked savings scheme with the statutory lock in of 3 years and tax benefit. | ||||||||||||

| Category of the Scheme | ELSS | ||||||||||||

| Investment Objective | The investment objective of the Scheme is to generate long-term capital appreciation from a diversified portfolio of predominantly equity and equity related instruments. However, there can be no assurance or guarantee that the investment objective of the Scheme would be achieved. | ||||||||||||

| Benchmark | NIFTY 500 TRI | ||||||||||||

| Entry / Exit Load | Nil | ||||||||||||

| Plans | Regular Plan and Direct Plan | ||||||||||||

| Options (Under each plan) | Dividend (Payout and Reinvestment) and Growth | ||||||||||||

| Minimum Application Amount | Rs. 500/- and in multiples of Re. 500/- thereafter | ||||||||||||

| Additional Application Amount | Rs. 500/- and in multiples of Re. 500/- thereafter | ||||||||||||

| Systematic Investment Plan(SIP) |

|

||||||||||||

| Minimum Redemption Amount | Rs. 500/- and in multiples of Re. 1/- thereafter or account balance, whichever is lower | ||||||||||||

| Fund Manager : | Mr. Aditya Khemani (For Equity Component) | Mr. Abhiroop Mukherjee (For Debt Component) | ||||||||||||

| About Fund Manager: | Mr. Aditya Khemani: He has over 14 years of experiencein equity management. Before joining Motilal Oswal AMC, he wasassociated with HSBC AMC, SBI Mutual Fund, ICICI PrudentialAMC. He has aPost Graduate Diploma from IIM Lucknow(MBA). | ||||||||||||

| Mr. Abhiroop Mukherjee – He is B.com (H), MBA with 10 years of experience in Trading Fixed Income Securities viz. G-sec, T-bills, Corporate Bonds CP, CD etc. He has earlier worked with PNB GILTS LTD. as a WDM Dealer for the period 2007-2011 | |||||||||||||

| Other Funds Managed by Mr. Abhiroop Mukherjee: He is the Fund manager for the debt component of Motilal Oswal Focused 25 Fund, Motilal Oswal Midcap 30 Fund, Motilal Oswal Multicap 35 Fund and Motilal Oswal Dynamic Equity. |

| Name of the scheme | Scheme Riskometer | Benchmark Riskometer Nifty 500 TRI |

| Motilal Oswal Long Term Equity Fund (An open ended equity linked saving scheme with a statutory lock in of 3 years and tax benefit) |

|

|

| Product Labeling | ||

| This product is suitable for investors who are seeking | ||

| 1) Long-term capital growth | ||

| 2) Investment predominantly in equity and equity related instruments | ||

| *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. | Investors understand that their principal will be at Very High risk | |