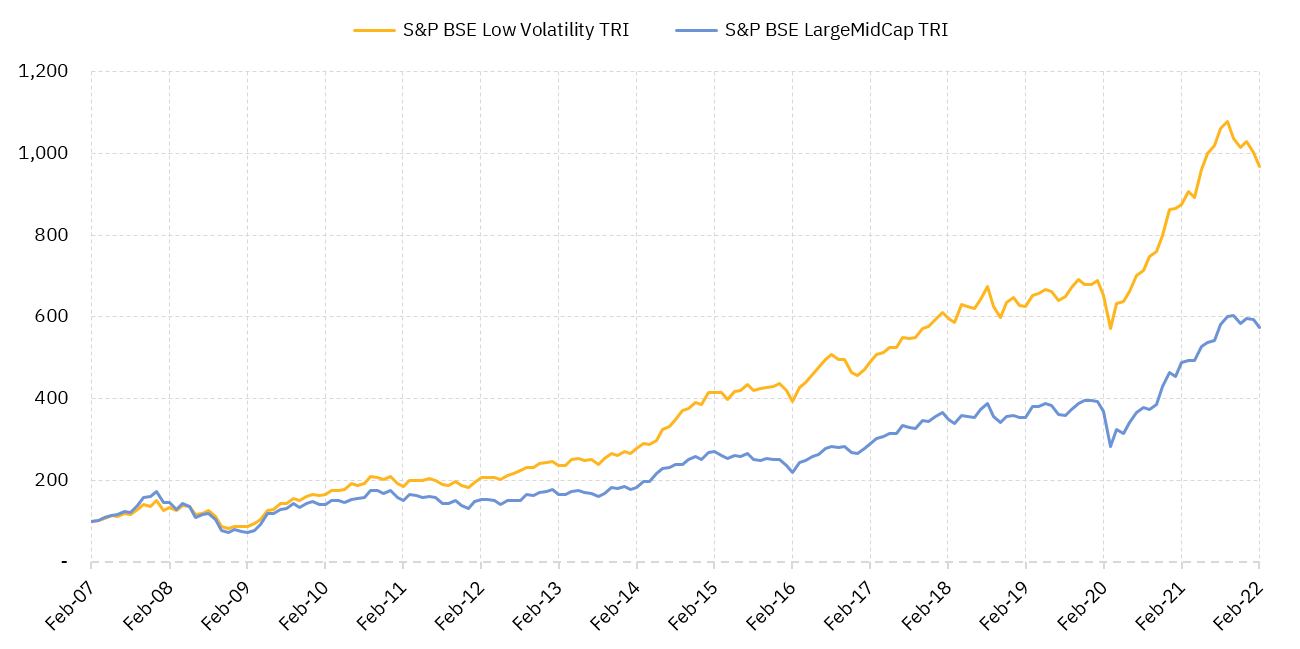

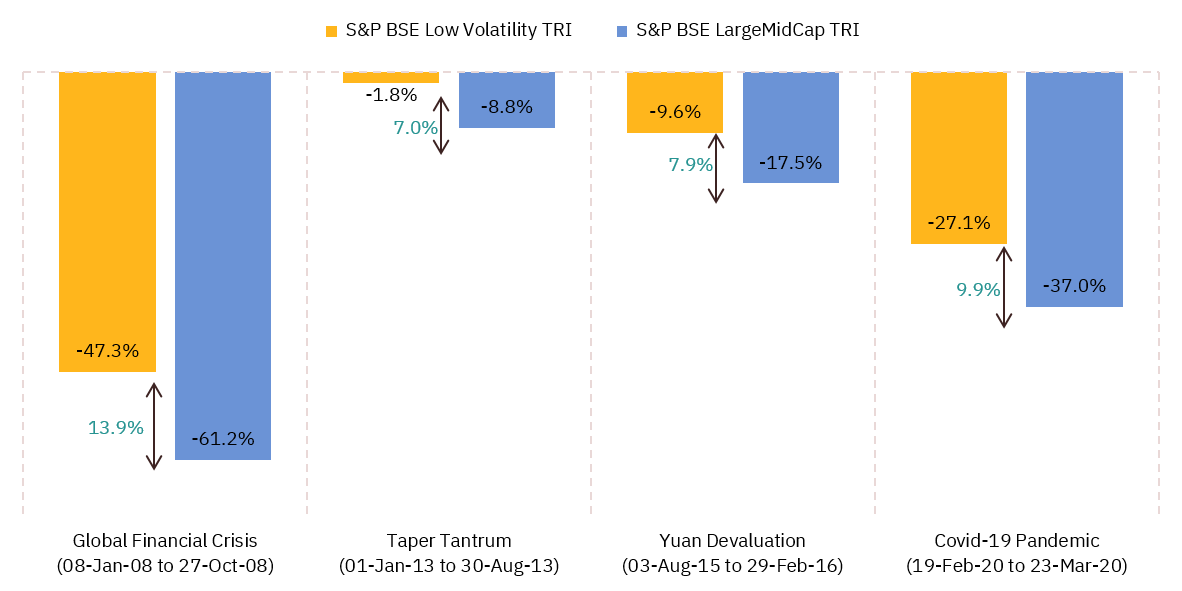

Theory says that investors can expect to earn higher returns by taking on higher risk.

Don’t let

stock market volatility affect you

Motilal Oswal

S&P BSE Low Volatility Index Fund & ETF