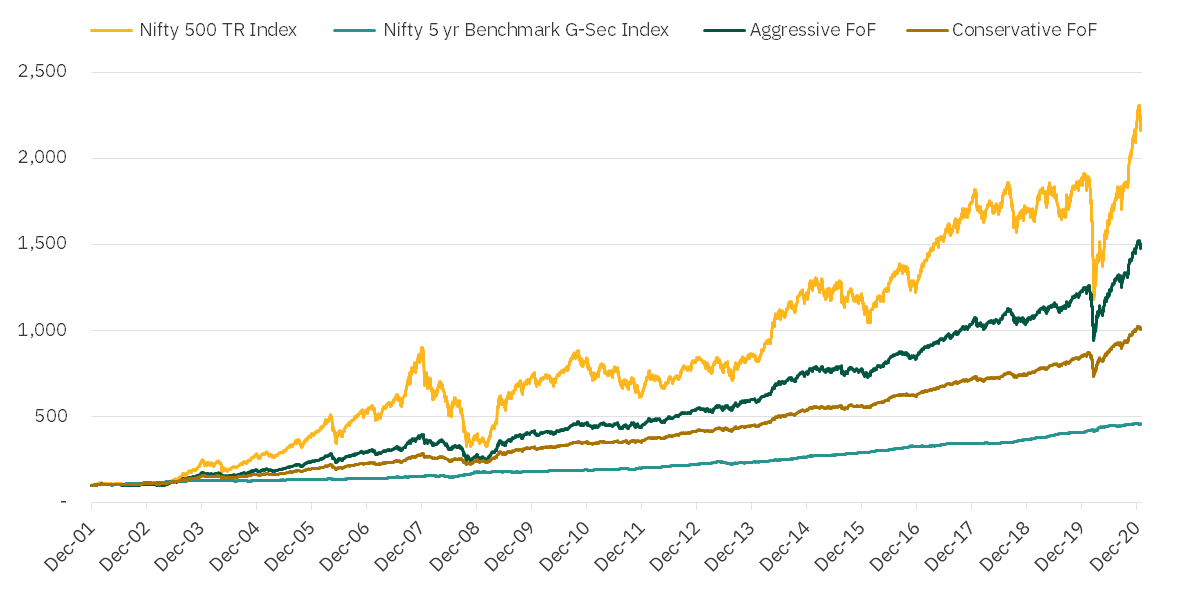

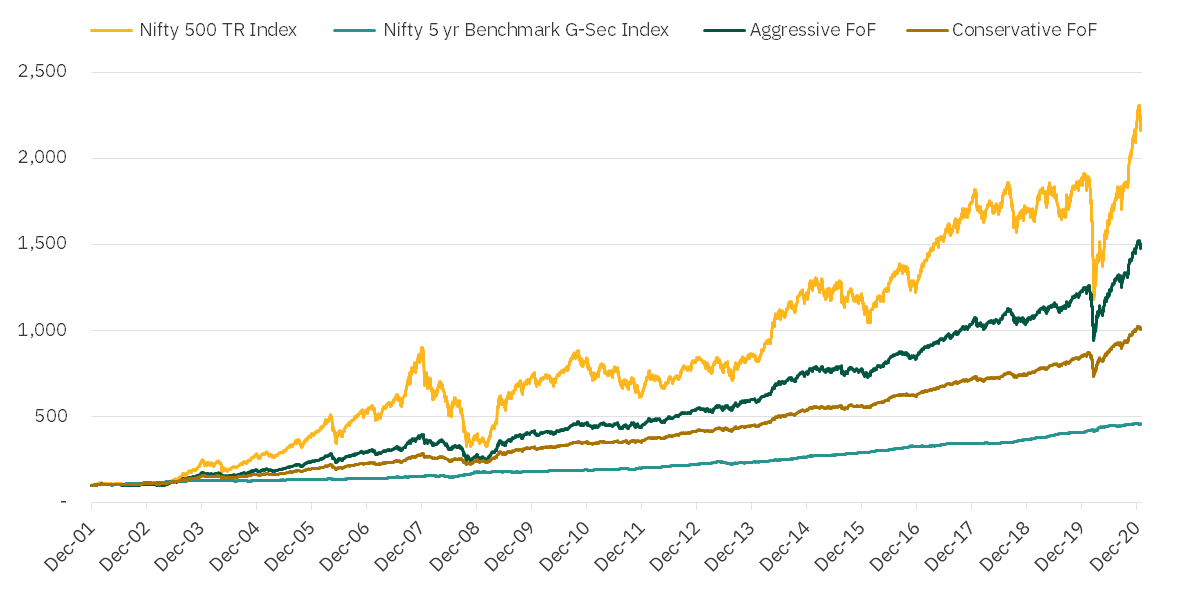

Source/Disclaimer: MOAMC Research, Index values - www.niftyindices.com, MOAMC. Exchange rate- FBIL/RBI/Thomson Reuter. Performance data since 31-Dec-2001 to 31-Jan-2021. Performance for Aggressive FoF and Conservative FoF is simulated using ‘indicative FoF allocations’ mentioned above section. The ‘underlying benchmarks’ used to for hypothetical study with no adjustment for cost. For historical analysis Gold prices denominated in INR sourced from factset. All Performance data in INR. S&P 500 Index values adjusted for one day lag movement due to different time zone. Performance results have many inherent limitations and no representation is being made that any investor will, or is likely to achieve. The above graph is used to explain the concept and is for illustration purpose only and should not used for development or implementation of an investment strategy. Past performance may or may not be sustained in future