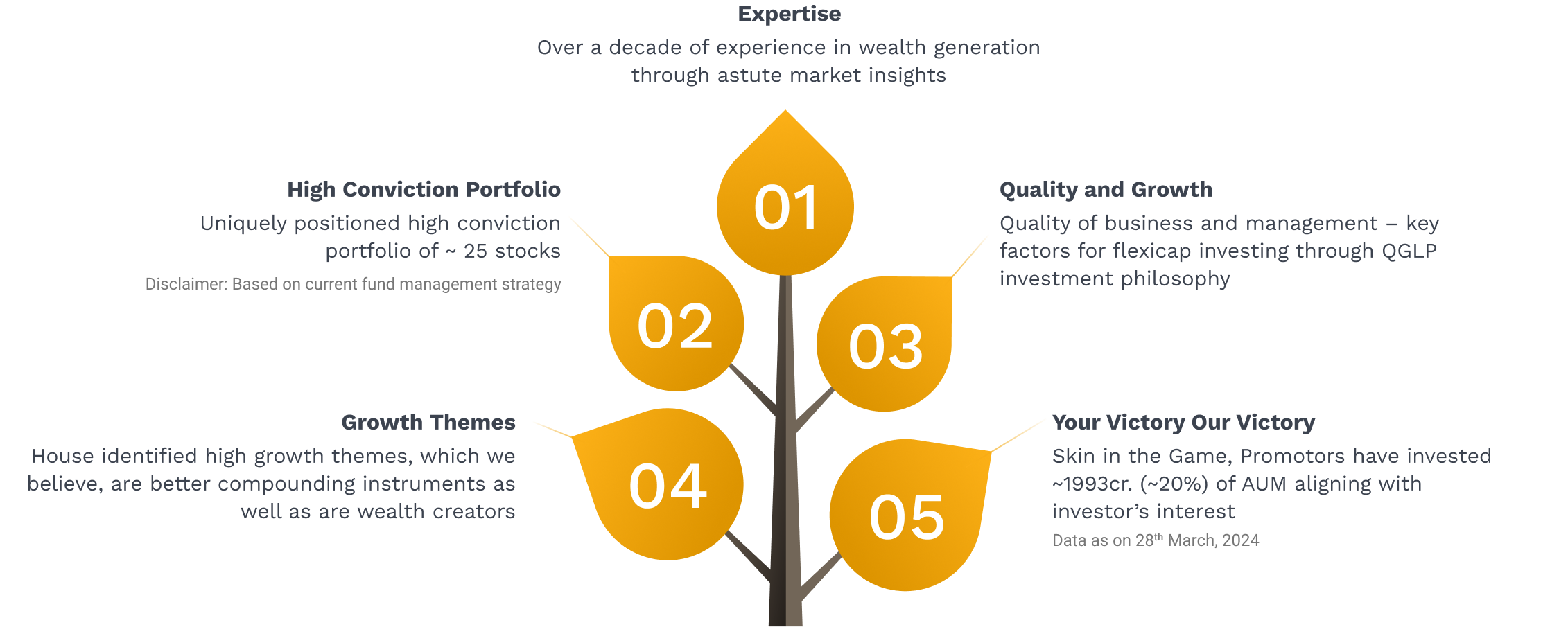

Why invest in Motilal Oswal Flexicap fund?

Consistency Is the key

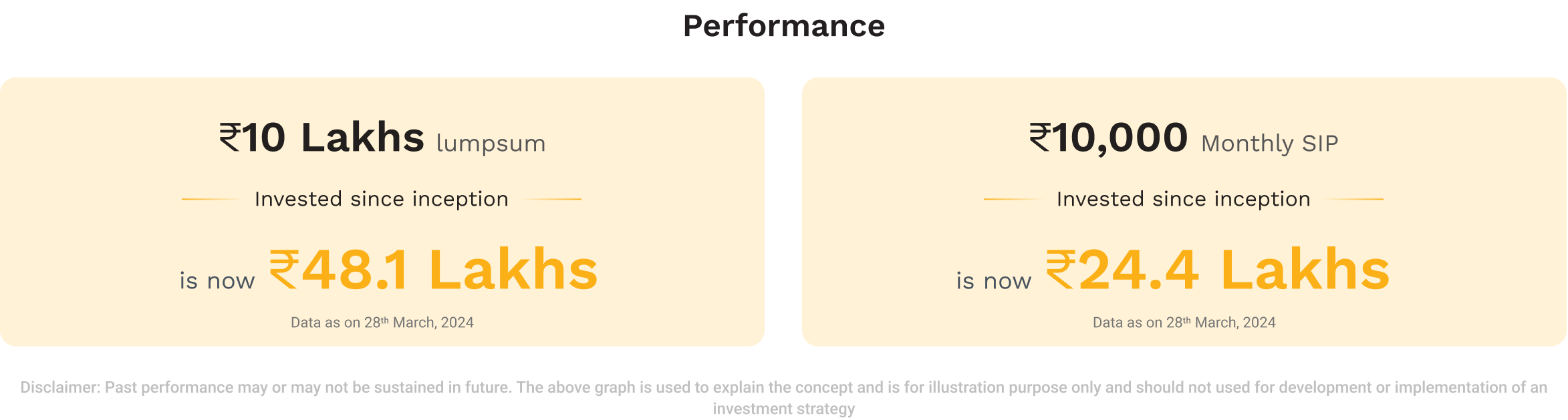

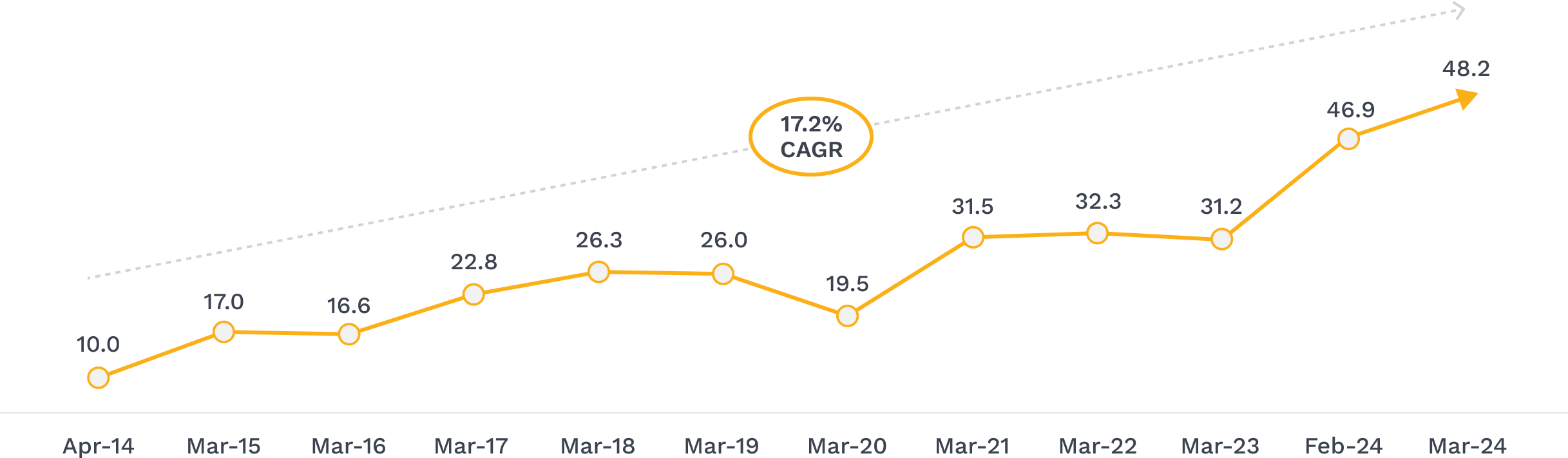

Motilal Oswal Flexicap Fund has consistently created Wealth for investors for over a Decade

Data as on Feb 29th 2024 The above graph is used to explain the concept and is for illustration purpose only and should not used for development or implementation of an investment strategy. Past performance may or may not be sustained in future.

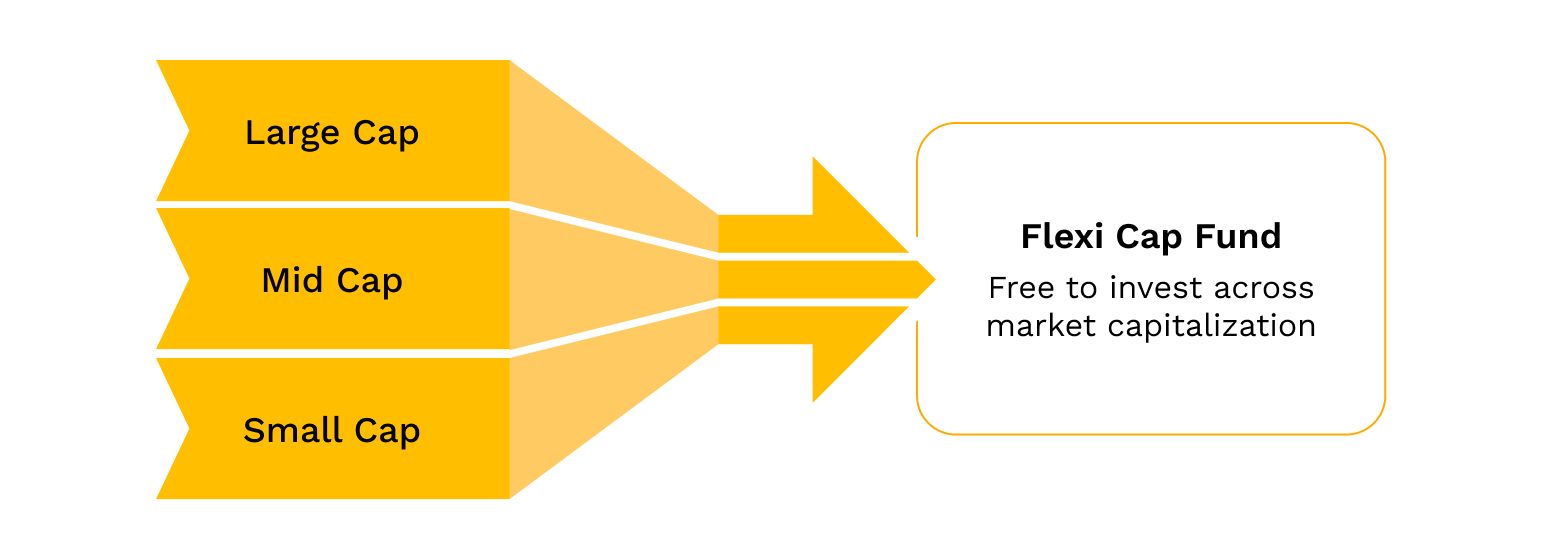

Why Flexicaps?

Flex Your Portfolio

High Earning Potential

Diversified Performance

Capture the growth of different index in a single fund without category restrictions

Source: Motilal Oswal AMC Internal Research, Wealth creation study. Disclaimer: Past performance may or may not be sustained in future. The above graph is used to explain the concept and is for illustration purpose only and should not used for development or implementation of an investment strategy.

Want to Know more about the Flexicap Fund?

Here's what our Fund Manager, Niket Shah has to say.

Fund Name

Latest AUM

Portfolio Turnover Ratio

Plans

Options (Under each plan)

Benchmark

Total Expense Ratio

Minimum Application Amount

Minimum Redemption Amount

Investment Objective

The investment objective of the Scheme is to achieve long term capital appreciation by primarily investing in equity & equity related instruments across sectors and market-capitalization levels. However, there can be no assurance or guarantee that the investment objective of the Scheme would be achieved.