Why invest in Motilal Oswal Large Cap fund?

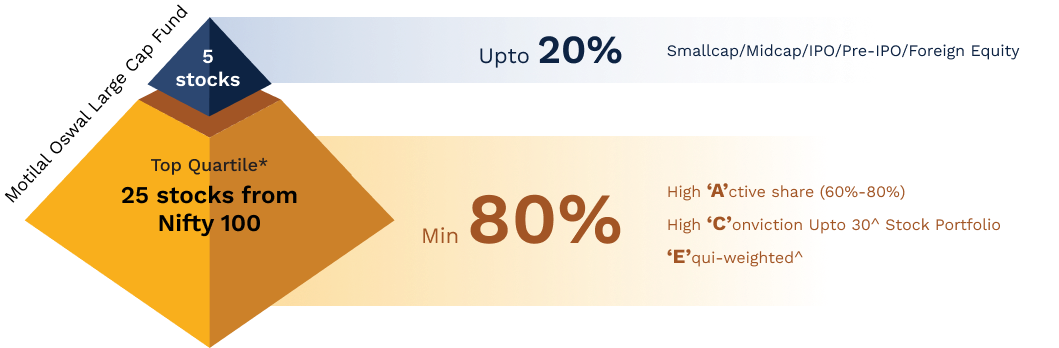

^Expected portfolio construct

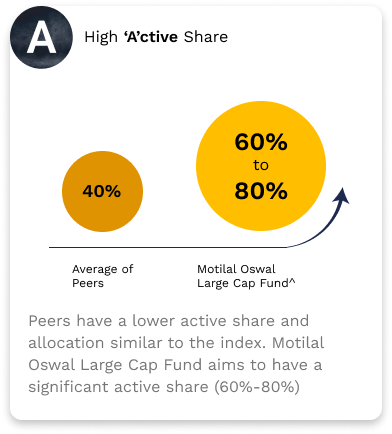

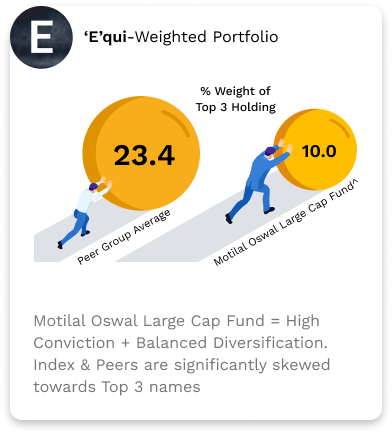

For analysis, funds with minimum 5,000 crs of AUM have been considered as peers out of total 30, which contributes to ~94% of total category AUM.

Source: ICRA, Motilal Oswal Internal Analysis. Data as of Nov’23. Disclaimer: Past performance may or may not be sustained in future. The above data is used to explain the concept and is for illustration purpose only and should not used for development or implementation of an investment strategy. ^up to 20% of the portfolio may be an exception to the above frameworks . The above construct is based upon our current fund management/ investment strategy. However the same shall be subject to change basis the disclosures made in the SID and KIM of the scheme.

A Unique Portfolio Construct

^Top Quartile stocks are based on the expected returns and not based on market cap.

Disclaimer: Past performance may or may not be sustained in future. The above data is used to explain the concept and is for illustration purpose only and should not used for development or implementation of an investment strategy. *up to 20% of the portfolio may be an exception to the above frameworks . The above construct is based upon our current fund management/ investment strategy. However the same shall be subject to change basis the disclosures made in the SID and KIM of the scheme.

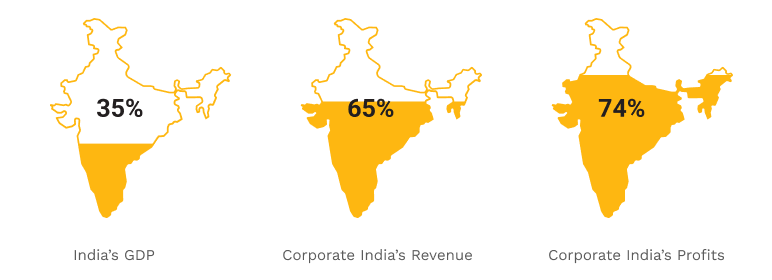

Why Large Cap?

Big Impact

High Growth Potential

High Price Potential

Big Recovery

Large Caps are 35% of India’s GDP; 65% of of the sales of Nifty Total Market Index & 74% of Corporate India’s Profits (listed companies)

Data as on FY23. Source: Capital IQ, Bloomberg, MOAMC Internal Research. Revenue and profit data has been calculated basis top 750 listed companies. The above graph is used to explain the concept and is for illustration purpose only and should not used for development or implementation of an investment strategy.

Indian Large Caps Track Record: ~29x Over Last 21 Years

Here's what our Fund Manager, Atul Mehra has to say.

Fund Name

Latest AUM

Portfolio Turnover Ratio

Plans

Options (Under each plan)

Benchmark

Total Expense Ratio

Minimum Application Amount

Minimum Redemption Amount

Investment Objective

The investment objective of the Scheme is to achieve long term capital appreciation by predominantly investing in equity and equity related instruments of large cap companies. However, there can be no assurance that the investment objective of the scheme will be realized.

Type

Entry load

NIL

Exit load

1% - If redeemed on or before 15 days from the Inception Date. Nil - If redeemed after 15 days from the Inception Date. A switch-out or a withdrawal shall also be subjected to the Exit Load like any Redemption. No Exit Load applies for switch between Motilal Oswal Focused Fund, Motilal Oswal Midcap Fund, Motilal Oswal Flexi Cap Fund, Motilal Oswal Large and Midcap Fund & Motilal Oswal Balanced Advantage Fund. No Load for switch between Options within the Scheme. Further, it is clarified that there will be no exit load charged on a switchout from Regular to Direct plan within the same scheme. No Load shall be imposed for switching between Options within the Scheme

Fund Managers

FAQs

What is Large Cap?

Why Large Caps?

Indian Large Caps are still global mid and small caps: Indian large caps can be perceived as global mid and small caps. With only three Indian companies ranking in the Global Top 100 by Market Cap, the 41st largest market cap company in India doesn't make the global top 1000 list, and the 100th Indian company ranks 2142nd globally.Anticipating India's ascent in the global economic arena, the potential inclusion of more Indian companies in the top 100 globally could lead to significant wealth creation. Therefore, Indian large caps, despite their domestic dominance, offer substantial growth potential on the global stage.

Large Caps: Lower Drawdowns, Faster Recovery: Large caps exhibit lower drawdowns and quicker recoveries compared to mid and small caps, ensuring higher capital protection with reduced volatility. This characteristic makes large caps an attractive choice for investors seeking stability and a favourable risk- return profile.

Large caps can provide fair return over medium to long term: Over the last 21 years, Large caps (Nifty 100 TRI) have grown nearly 29 times, compounding at ~17.4%. Considering a 7-year investment horizon, there's a 98.2% chance of achieving returns exceeding 7%, rising to 99.2% for a 10-year period.

Why Large Caps Now?

Highest Quality, Lowest Valuations: Despite boasting the highest quality metrics based on RoE, Nifty 100 is trading at lower valuations compared to Mid, Small, and Microcap categories, presenting a potential re-rating opportunity. This is intriguing given Nifty 100's increased share in overall sales and profit pool, even though its market cap share has decreased from 72.3% in 2018 to 64% presently. Despite a recent rally, Nifty 100 valuations remain attractive, with the current PE (23.4x) reasonably lower than the last peak.

Expect FIIs to return strongly: FII ownership in NSE500 are at multi-year lows (20.0%) and below historical average (21.2%). We expect the same to mean revert leading to higher flows in large caps as their overall holding in large caps is over 85%.

DII flows have been majorly skewed towards mid/small caps; However, we have started seeing net inflows in large cap mutual funds in the last 2 months: While DII flows have been skewed towards mid/small caps, recent trends show net inflows into large caps since the last two months. This shift from SMID to large caps, driven by attractive valuations is expected to continue in early 2024.

Large caps have performed consistently across time periods: Large Caps have been consistently performing by being in the top 2 quartiles for 9 out of 11 years in comparison to other categories and asset classes. This provides opportunities to investors willing to invest for long term with lower volatility and consistency in returns.