Why invest in Motilal Oswal Small Cap fund?

Disclaimer: Past performance may or may not be sustained in future. The above graph is used to explain the concept and is for illustration purpose only and should not used for development or implementation of an investment strategy.

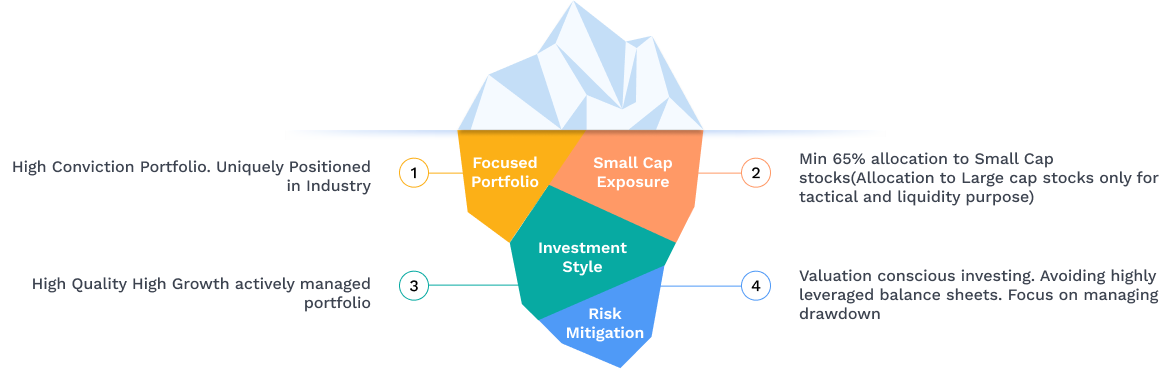

Portfolio Construct

Disclaimer: Past performance may or may not be sustained in future. The above graph is used to explain the concept and is for illustration purpose only and should not used for development or implementation of an investment strategy. The term ‘Hi-Quality and Hi- Growth Portfolios’ refer to Motilal Oswal AMC’s defined fund management processes based on internal qualitative and quantitative research parameters & not be construed as investment advice to any party.

Why Small Cap?

High Growth Potential

Small Is Getting Bigger

Under researched companies

Large Investible Universe

Under Ownership

Unique Sectors

Enhance your long term wealth creation by leveraging smallcap’s potential for earnings growth

Source: Bloomberg, Prowess CMIE. Note : Earning growth are annualized. FY 08 - 23 growth calculated as average of EPS CAGR for each category. ^Nifty Smallcap 250 index data available since 1st Apr’05. As of 30th Jun’23 classification by SEBI Past performance may or may not be sustained in future. The above graph is used to explain the concept and is for illustration purpose only and should not used for development or implementation of an investment strategy.

Nifty Smallcap 250 TRI offered better historical long-term returns

Want to Know more about the Small Cap Fund?

Here's what our Fund Manager, Ajay Khandelwal has to say.

Fund Name

Latest AUM

Portfolio Turnover Ratio

Plans

Options (Under each plan)

Benchmark

Total Expense Ratio

Minimum Application Amount

Minimum Redemption Amount

Investment Objective

Type

Entry load

Exit load

1% - If redeemed on or before 1 year from the Inception Date. Nil - If redeemed after 1 year from the Inception Date. A switch-out or a withdrawal shall also be subjected to the Exit Load like any Redemption. No Exit Load applies for switch between Motilal Oswal Focused Fund, Motilal Oswal Midcap Fund, Motilal Oswal Flexi Cap Fund, Motilal Oswal Large and Midcap Fund & Motilal Oswal Balanced Advantage Fund. No Load for switch between Options within the Scheme. Further, it is clarified that there will be no exit load charged on a switchout from Regular to Direct plan within the same scheme. No Load shall be imposed for switching between Options within the Scheme

Fund Managers

FAQs

What is small cap?

Why Small Caps?

Growing Market: 38x increase in the largest small cap's market cap in 20 years. 537 small cap companies with a market cap above 2,000 Cr for diverse selection.

Under-Researched Opportunities: Limited analyst coverage, creating opportunities for professional research. Expert portfolio management crucial for navigating the small cap landscape.

Investment Case: Distinctive earnings and returns profile emphasizes the importance of expertise. Large investible universe (4,813 companies) creates potential for alpha generation.

Unique Sectors: Opportunities in high-growth segments not well-represented in large caps. Access to unique and niche sectors within the broader market.

Why Small Caps Now?

Healthier Balance Sheets: Net debt-to-equity ratio decline from 0.76x (FY15) to 0.3x (FY23). Reduced reliance on external funds, with 70% of fund raises since FY21 through offer for sale.

Strong Trend of Retail Investment Flows: Small cap category attracts 26% of net flows in active mutual funds in 2023. Noteworthy rise in SIP flows, with a more than 2x increase to 2,200 crores in 2 years, providing stability against extreme volatility.

Trading at Reasonable Valuations: Despite past concerns, current small cap PE is at a 17% premium over Nifty 50. TTM P/E ratio well below peak, indicating favorable earnings growth potential.

General Elections Run-Up as a Comfortable Period: Historical data shows substantial small cap rallies in the six months leading up to general elections. Nifty Smallcap 250 index experienced significant rallies in 2009, 2014, and 2019.

Higher Exposure to Domestic Market: Small cap index companies have 12% of revenues from exports (FY23) vs. 23% for Nifty 50. Greater orientation towards domestic markets provides better visibility of earnings growth.

Small Caps Poised for Next Rate Cycle: Correction during rising interest rates followed by a robust rally. Expectations of rate cuts position small caps for further upward momentum.