High Quality High Growth Portfolios

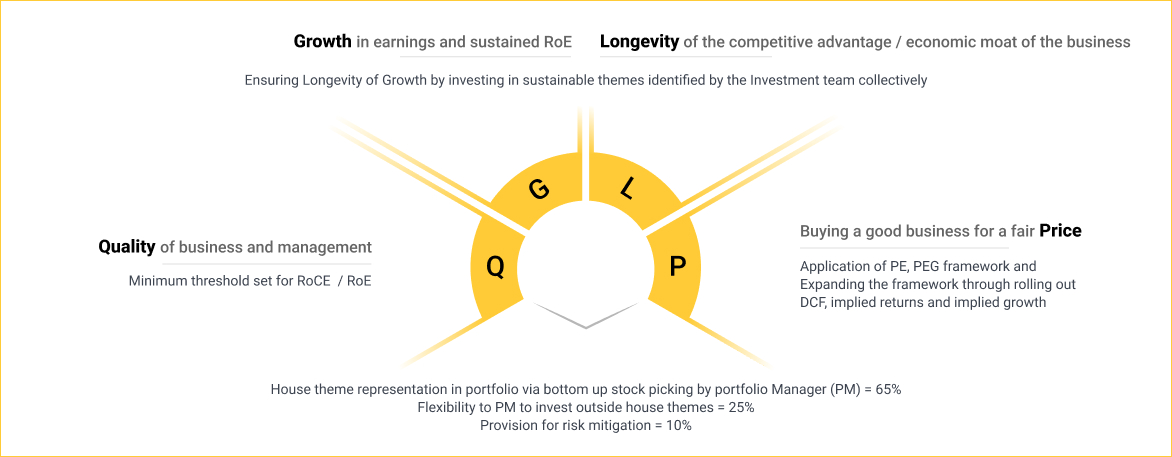

Our core investment philosophy of QGLP, reinforced by robust risk management processes drives the creation of high quality, high growth portfolios to manage all our assets. Combination of high quality and high growth is the sweetest spot. Founded on a set of principles and beliefs that guide our investment decisions we firmly believe that this philosophy is a key driver of long-term financial success for our clients.

High Quality

From sustainability of growth comes Quality. Both Quality of Business and Quality of Management matter. Quality of Management is judged from efficiency of capital allocation. Judicious and timely deployment of capital is key sustainable success of a business. Quality of Business measured by return on invested capital (ROIC) for non-finance companies and by Return on Equity (ROE) for finance companies. Business with low debt and high ROIC/ROE can continue to fund growth over long term through internal accruals and less reliance on borrowed money or equity dilution.

High Growth

We focus on investing in businesses, which are on a high and sustainable profit growth path. In the long term, stock prices are slaves of earnings. Hence higher and sustainable growth leads to better long term compounding. These investments typically belong to industries or companies that are positioned for expansion, innovation, and long-term profitability.

Robust Risk Management

Risk management is a critical aspect of investment portfolio construction. It helps awareness towards need for Preservation of Capital, Long-Term Stability and Risk-Return Trade off. We have imbibed stringent risk management framework in our investment process. Focusing on Stock and Sector weightage & Sizing, diversification, profit taking/stop loss and liquidity frameworks.

In summary, risk management is a crucial aspect of investment portfolio construction as it helps optimise the return and risk trade-off for optimal portfolio construction. It involves a combination of strategic decisions, diversification, and ongoing monitoring to adapt to changing market conditions.

Minimum and maximum exposure limits set

Limits on sector deviations relative to benchmark

Proprietary framework for measuring triggers

Portfolio size capped up to 35 stocks

Ensuring efficient management for ability to take necessary action

Our Process, Your Success

"Our Process, Your Success" signifies our unwavering adherence to proven processes developed over decades of equity research and investing experience with a clear objective of charting a seamless path to your financial success.

Explore High Quality High Growth Portfolios🡢Expert Talks

Hi-Quality. Hi-Growth.Benefit from Both with Prateek Agrawal