Most Asked

What is a Mutual Fund?

What does a Mutual Fund do with investor`s money?

What is the Regulatory Body for Mutual Funds?

Why should I choose to invest in a mutual fund?

For a retail investor who does not have the time and expertise to analyze and invest in stocks and bonds, mutual funds offer a viable investment alternative.

This is because:

1. Mutual Funds provide the benefit of cheap access to expensive stocks

2. Mutual funds diversify the risk of the investor by investing in a basket of assets

3. A team of professional fund managers manages them with in-depth research inputs from investment analysts.

4. Being institutions with good bargaining power in markets, mutual funds have access to crucial corporate information which individual investors cannot access.

What are the advantages of investing in a Mutual Fund?

There are several benefits from investing in a Mutual Fund.

A. Small investments: Mutual funds help you to reap the benefit of returns by a portfolio spread across a wide spectrum of companies with small investments. Such a spread would not have been possible without their assistance. Professional Fund Management: Professionals having considerable expertise, experience and resources manage the pool of money collected by a mutual fund. They analyze markets and the economy to select good investment opportunities.

B. Spreading Risk: An investor with a limited amount of fund might be able to invest in only one or two stocks / bonds, thus increasing his or her risk. However, a mutual fund will spread its risk by investing in a number of sound stocks or bonds, across sectors, so the risk is diversified, along with taking advantage of the position it holds. Also in cases of liquidity crisis where stocks are sold at a distress, mutual funds have the advantage of the redemption option at the NAVs (Net Asset Values).

C. Transparency and easy access to information: Mutual Funds regularly provide investors with information on the value of their investments. Mutual Funds also provide complete portfolio disclosure of the investments made by various schemes and also the proportion invested in each asset type and clearly layout their investment strategy to the investor.

D. Liquidity: Closed ended funds have their units listed at the stock exchange, thus they can be bought and sold at their market value. Over and above this the units can be directly redeemed to the Mutual Fund as and when they announce the repurchase.Open ended funds, the units are available for subscriptions redemption on all business days on an ongoing basis.

E. Choice: The large amount of Mutual Funds offer the investor a wide variety to choose from. An investor can pick up a MF scheme depending upon his risk / return profile.

F. Regulations: All the mutual funds are registered with SEBI and they function within the provisions of strict regulation designed to protect the interests of the investor.

How do mutual funds diversify their risks?

Can mutual funds be viewed as risk-free investments?

What are the risks involved in investing in mutual funds?

What are the different types of Mutual funds?

On the basis of Objective

A. Equity Funds/ Growth Funds

Funds that invest in equity shares are called equity funds. They carry the principal objective of capital appreciation of the investment over the medium to long-term. The returns in such funds are volatile since they are directly linked to the stock markets. They are best suited for investors who are seeking capital appreciation. There are different types of equity funds such as Diversified funds, Sector specific funds and Index based funds.

B. Diversified funds

These funds invest in companies spread across sectors. These funds are generally meant for risk-taking investors who are not bullish about any particular sector.

C. Sector funds

These funds invest primarily in equity shares of companies in a particular business sector or industry. These funds are targeted at investors who are extremely bullish about a particular sector.

D. Index funds

These funds-invest in the same pattern as popular market indices like CNX Nifty Index and BSE Index. The value of the index fund varies in proportion to the benchmark index.

E. Tax Saving Funds

These funds offer tax benefits to investors under the Income Tax Act.Opportunities provided under this scheme are in the form of tax rebates u/s 88, saving in Capital Gains u/s 54EA and 54EB and deductions u/s 80C. They are best suited for investors seeking tax concessions.

F. Debt / Income Funds

These Funds invest predominantly in high-rated fixed-income-bearing instruments like bonds, debentures, government securities, commercial paper and other money market instruments. They are best suited for the medium to long-term investors who are averse to risk and seek capital preservation. They provide regular income and safety to the investor.

G. Liquid Funds / Money Market Funds

These funds invest in highly liquid money market instruments. The period of investment could be as short as a day. They provide easy liquidity. They have emerged as an alternative for savings and short-term fixed deposit accounts with comparatively higher returns. These funds are ideal for Corporates, institutional investors and business houses who invest their funds for very short periods.

H. Gilt Funds

These funds invest in Central and State Government securities. Since they are Government backed bonds they give a secured return and also ensure safety of the principal amount. They are best suited for the medium to long-term investors who are averse to risk.

I. Balanced Funds

These funds invest both in equity shares and fixed-income-bearing instruments(debt) in prescribed proportion. They provide a steady return and reduce the volatility of the fund while providing some upside for capital appreciation. They are ideal for medium- to long-term investors willing to take moderate risks.

What are open-ended and closed-ended mutual funds?

What is NAV?

How much return can I expect by investing in mutual funds?

What are the types of returns one can expect from a Mutual Fund?

A. Capital Appreciation : An increase in the value of the units of the fund is known as capital appreciation. As the value of individual securities in the fund increases, the fund`s unit price increases. An investor can book a profit by selling the units at prices higher than the price at which he bought the units.

B. Dividend Distribution: The profit earned by the fund is distributed among unit holders in the form of dividends. Dividend distribution again is of two types. It can either be re-invested in the fund or can be on paid to the investor.

How do I track the performance of the Fund?

What is a load?

When a charge is collected at the time of entering into the scheme it is called an Entry load. The entry load percentage is added to the NAV at the time of allotment of units. However SEBI has now prohibited charging entry load on mutual fund schemes. An Exit load is a charge that is collected at the time of redeeming or for transfer between schemes (switch). The exit load percentage is deducted from the NAV at the time of redemption or transfer between schemes.

Some schemes do not charge any load and are called "No Load Schemes".

How does the concept of exit load work in case of unit redemptions?

Can an investor redeem part of the units?

What are the differences between close-ended mutual funds and ETFs?

Though Close-Ended Mutual Funds are listed on the exchange they have a limited number of shares and trade at substantial premiums or more often at discounts to the actual NAV of the scheme. Also, they lack the transparency, as one does not know the constitution and value of the underlying portfolio on a daily basis.

In ETFs, the numbers of units issued are not limited and can be created/ redeemed throughout the day. ETFs rely on market makers and arbitrageurs to maintain liquidity so as to keep the price in line with the actual NAV.

What is Portfolio Management Services (PMS)?

PMS (Portfolio Management Service) is a tailor made professional service offered to cater the investments objective of different investor classes. The Investment solutions provided by PMS cater to a niche segment of clients. The clients can be Individuals or Institutions entities with high net worth. In simple words, PMS (portfolio management service) provides professional portfolio management of your investments to create wealth..

What are the benefits of MOSt Portfolios?

1. Professional Management : PMS provides professional management of portfolios with the objective of delivering consistent long-term performance while controlling risk.

2. Constant Portfolio Tracking : We understand the dynamics of equity as an asset class, so we track your investments continuously to maximize the returns.

3. Risk Control : Well defined investment philosophy & strategy acts as a guiding principle in defining the investment universe. We have very robust portfolio management software that enables the entire construction, monitoring and the risk management processes.

4. Convenience : Our Portfolio Management Service relieves you from all the administrative hassles of your investments. We provide periodic reports on the performance and other aspects of your investments.

5. Transparency : You will get account statements and performance reports on a monthly basis. That’s not all; web access will enable you to track all information relating to your investment on daily basis.A password protected web login will enable you to access details of your investment on click of a button. The following portfolio reports are accessible online:

5.1 Performance Statements

5.2 Portfolio Holding Reports

5.3 Transactions Statements

5.4 Capital Gain/Loss Statements

Along with it we also send half yearly reports and yearly Audited reports for convenient Tax Filing.

6. Dedicated Relationship Manager : Your Relationship manager will help you carefully understand your financial goals and advise you the right product mix. The relationship managers ensure that you receive periodic updates and account performance reports.

7. Personalized Approach : In PMS, you gain direct personalized access to the professional money managers who actively manage your portfolio. This interaction may come in various different ways including in-person meetings, conference calls, written commentary, etc. with the fund management team.

Will it help me on my tax status?

How can I monitor the performance of my portfolio?

As a part of our service offering and in an endeavor to provide complete transparency of the dealings in the clients PMS account, the following reports are emailed to the clients to their registered email id/ mailed to the correspondence address, which will enable the clients to track their portfolios. The reports are sent on a monthly basis before the 10thof the next month.

1. Account Performance Statement

2. Holding Statement

3. Transaction Statement

4. Capital Movement Statement

5. Corporate Action Statement

6. Debit Note

7. Client Information

8. Taxable Gain/Loss statement

9. Clients are provided with a login id and password which will enable 24*7access to the details of the investments on click of a button.

10. Audited reports certified by a CA will be sent to all clients annually after March-year end audit is completed.

Do I have to keep a track on investments and take part in investment decision making process?

Motilal Oswal Asset Management Company Ltd provides discretionary Portfolio Management Services wherein the portfolio manager manages your portfolio without having to bother you with the day to day decisions. The portfolio manager takes all the investment decisions on your behalf.

However, we do a comprehensive reporting to maintain complete transparency in managing your portfolio. You will receive regular updates and a detailed report on your portfolio, allowing you to track its activity and performance.

Can I specify sectors that I want or don’t want to hold?

Can I meet my portfolio management/ Investment Advisory team and discuss portfolio?

Can I book my profits partially any time?

How can I add further investments to my existing PMS account with MOAMC PMS?

How can I put in money in my PMS account?

Your PMS account will activate only after you deposit a minimum of Rs. 50 lacs in the account (combination of cash and stocks). To put in money, you can use one of the following ways:

1.Cheques:

will be in the name of Motilal Oswal Asset Management Company Ltd.–PMS for all strategies. The strategy names will not be required to be mentioned on the cheques

2.Bank Transfer:

If you have banking facilities you can transfer funds in Indian Rupees to your PMS account by online transfer (RTGS/NEFT) or wire transfer.

Can I use my DMAT holdings of stocks to make investment in the Motilal Oswal Asset Management Company Ltd PMS account?

Can a NRI avail of the Portfolio Management Service?

Can I open a PMS account with a combination of cash and stocks?

Who can open a PMS account with Motilal Oswal Asset Management Company Ltd.?

You can open a PMS account with us, if you are:

1. An Individual

2. A Hindu Undivided Families

3. An Association of Persons

4. A Limited Companies

5. An NRI, overseas company, firm, society or an overseas trust (subject to RBI approval)

How do I open a portfolio management service account (PMS) with Motilal Oswal Asset Management Company Ltd.?

You can open a PMS account by emailing or calling us at our exclusive PMS desk. Once we receive your request one of our executives will get in touch with you shortly. You can call us on: 1800-200-6626 or email us at: pmsquery@motilaloswal.com.

You can visit our Website: www.motilaloswal.com/Asset-Management

Why should I select Motilal Oswal AMC’s Portfolio Management Services?

1. Amongst India’s one of the leading PMS Service Providers, with Assets under Management of approx Rs. 2700 Crores as on 31st December 2014.

2. Value Strategy is the single biggest discretionary PMS strategy in the country withal of over Rs. 1225 crores as on 31st December 2014 clearly showing client’s trust in our product’s performance &services.

3. Our Flagship “Value Strategy” has consistently outperformed the benchmark across market cycles over a 11 year period.

4. Motilal Oswal PMS has one of the largest active customer base of 4500+ on PMS Platforms on 31st December 2014 clearing showing strong trust developed with customers.

5. 1crore invested in Value PMS in March 2003 is worth Rs. 17.86 crores as on 31st December 2014 v/s. just 8.19 Crores if it would have been invested in CNX Nifty Index.

6. Motilal Oswal Portfolio Management Services has active clients in 138 different cities right from Agra to Vijayawada; a testimony of strong acceptance of our PMS across the length & breadth of the country.

Data as on 31st December 2014

Investments in Securities are subject to market and other risks and there is no assurance or guarantee that the objectives of any of the strategies of the Portfolio Management Services (PMS) will be achieved. Investors in the PMS Product are not being offered any guaranteed/assured returns. Past performance of the portfolio manager does not indicate the future performance for any of the strategies.

What is an SIP?

2. It is similar to a regular saving scheme like a recurring deposit.

3. It allows the investor to buy units as per a pre decided frequency; the investor decides the amount and also the scheme / scrip to invest in.

4. Due to the principle of cost averaging, more number of units are bought in a falling market and fewer units in a rising market

5. SIPs allow you to take part in the stock market, without trying to time it, also bringing discipline to your investments.

What are the benefits of an SIP?

1. Power of saving:

The power of saving underlines the essence of making money work if only invested at an early age. The longer one delays in investing, the greater the financial burden to meet desired goals. Saving a small sum of money regularly at an early age makes money work with significant impact on wealth accumulation explained through the illustration below.

Illustration:

| At end of Year | 5% | 10% | 15% | 20% |

|

1 |

Rs.1,050 |

Rs.1,110 |

Rs.1,115 |

Rs.1,120 |

|

5 |

Rs.1,276 |

Rs.1,611 |

Rs.2,011 |

Rs.2,488 |

|

10 |

Rs.1,623 |

Rs.2,594 |

Rs.4,046 |

Rs.6,192 |

|

15 |

Rs.2,079 |

Rs.4,177 |

Rs.8,137 |

Rs.15,407 |

|

25 |

Rs.3,386 |

Rs.10,835 |

Rs.32,919 |

Rs.95,396 |

The above is for illustration purpose only. The SIP amount, tenure of SIP, expected rate of return and unit price are assumed figures for the purpose of explaining the concept of advantages of SIP investments. The actual result may vary from depicted results depending on scheme selected. It should not be construed to be indicative of scheme performance in any manner. Past performance may or may not be sustained in future.

2. Rupee Cost Averaging:

Timing the market is a difficult task. Rupee cost averaging is an automatic market-timing mechanism that eliminates the need to time one`s investments. Here, one need not worry about where share prices or interest are headed as investment of a regular sum is done at regular intervals; with fewer units being bought in a declining market and more units in a rising market. Although SIP does not guarantee profit, it can go a long way in minimizing the effects of investing in volatile markets.

3. Convenience:

Three simple paperless steps to invest in an SIP:

1.Register for an SIP online

2.Fill the required details

3.Ensure availability of funds

4. Disciplined Investing:

It’s the key to investing success. Regular investment makes you disciplined in your savings and also leads to wealth accumulation. Systematic investing is a time-tested discipline that makes it easy to invest automatically. Investing regularly in small amounts can often lead to better results than investing in a lump sum.

How does an SIP work?

An SIP means you commit yourself to investing a fixed amount every month.Let’s say it is Rs. 1000/-. When the market price of shares fall,the investor benefits by purchasing more units; and is protected by-purchasing less when the price rises. Thus the average cost of unit sis always closer to the lower end making the investment profitable.The illustration below explains the benefit of an SIP over a lump sum.

| SIP - Rupee Cost Averaging | |||||

| Lump-Sum Investor | SIP Investor | ||||

| Month | Unit Price (Rs.) | Investment (Rs.) | Unit Purchased^ | Investment (Rs.) | Units Purchased^ |

|

1 |

50 |

9,000 |

180 |

1,000 |

20 |

|

2 |

47 |

|

|

1,000 |

21 |

|

3 |

45 |

|

|

1,000 |

22 |

|

4 |

44 |

|

|

1,000 |

23 |

|

5 |

46 |

|

|

1,000 |

22 |

|

6 |

48 |

|

|

1,000 |

21 |

|

7 |

49 |

|

|

1,000 |

20 |

|

8 |

50 |

|

|

1,000 |

20 |

|

9 |

52 |

|

|

1,000 |

19 |

|

Total Investment |

Rs.9,000 |

Rs.9,000 |

|||

|

Total Units Purchased |

180 |

188 |

|||

|

Average Unit Price |

Rs.50 |

Rs.48 |

|||

|

Value After 9 Months |

Rs.9,360 |

Rs.9,799 |

|||

|

^Fractional units ignored |

|||||

Hence,at the end of the period total units purchased will be 188 & cost per unit will be Rs. 48/-. Thus, the profit from the above investment will amount to Rs. 799/- (Rs. 9,799 – Rs. 9,000)

The above is for illustration purpose only. The SIP amount, tenure of SIP, expected rate of return are assumed figures for the purpose of explaining the concept of advantages of SIP investments. The actual result may vary from depicted results depending on scheme selected. It should not be construed to be indicative of scheme performance in any manner. Past performance may or may not be sustained in future.

What is Motilal Oswal 5 Year G-Sec ETF?

Where would the fund manager invest my money?

Is it safe to invest in Motilal Oswal 5 Year G-sec ETF?

What is constant maturity structure?

Risk involved in Motilal Oswal 5 Year G-Sec ETF?

Typically the debt fund and especially G-Sec fund has lower risk in term of their price volatility over medium to long term. However yet there are few risks which need to be noted as below.

Credit Risk: The fund has practically NIL credit risk since it invests in Government Securities which is backed by Government of India.

Price Risk: The price of debt instruments including G-Sec is sensitive to changes in market interest rate, an increase in interest rate may cause bond prices to fall. The ETF is expected to have lower risk as compared to long duration G-Sec whereas higher risk as compared to short duration G-Sec.

Reinvestment Risk: Coupons received will be reinvested in the underlying index basis prevailing yield.

Liquidity Risk: The underlying index, includes security which is the most liquid G-Sec in the given duration bucket. Hence fund has low liquidity risk, given historical trend. This above list is indicative and not exhaustive, please read the offer document before investing or contact your financial advisor.

Are there any assured returns?

How can I invest in this fund?

What is the minimum application amount?

During NFO: Rs 500/- and in multiples of Re 1/- thereafter

On-going basis:

On Exchange: Investors can purchase/redeem units of ETF on Stocks Exchanges like equity share; the units can be bought/sold in round lots of 1unit and in multiples thereafter. We have appointed market makers to provide ongoing liquidity to buyers/sellers on exchange.

Directly with AMC: In addition units of ETF can be purchased/redeemed directly with the Mutual Fund for the creation unit size of 20,000 units (approx. amount of basket is INR 950,000/-1 )

What is the Total Expense Ratio of the ETF?

Is there an entry/exit load?

Are there any restrictions on purchase/withdrawal? Is there a lock-in period?

What happens to the Coupon payment received on the underlying security?

Who can invest in Motilal Oswal 5 year G-sec ETF?

Will this ETF be liquid on Stock Exchanges?

What is the Settlement Period for the Fund (buy & sell)?

What is tax treatment?

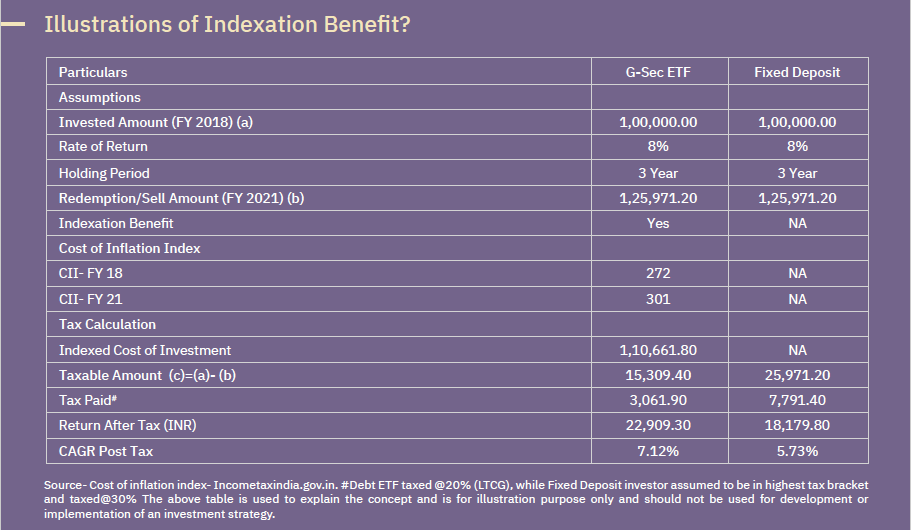

If the investment is held for more than 3 years it qualifies for Long Term Capital Gains Tax @ 20%, along with option to avail indexation benefit. Any investment horizon lower than 3 year, would attract the Short Term Capital Gain Tax and taxed as per the applicable tax bracket.

Where can I track this ETF? Or Is the investment transparent?

Can I hold it in physical form?

Is STP / SIP & SWP allowed in this fund during the NFO?

What are ETFs?

What is MOSt Shares M50

How is the price of MOSt Shares M50 determined?

What is minimum investment amount in MOSt Shares M50?

What are ETFs?

Exchange Traded Funds (ETFs) are open ended mutual fund schemes, which are traded on stock exchanges like a share and seek investment returns that correspond to the performance of a particular index like Nifty 50 or Nifty Free Float Midcap 100 Index.

It combines the benefit of mutual fund scheme with convenience of trading like a share.

What is Motilal Oswal MOSt Shares Midcap 100 ETF (MOSt Shares Midcap 100)?

Motilal Oswal MOSt Shares Midcap 100 Exchange Traded Fund (MOSt Shares Midcap 100) is an open ended index Exchange Traded Fund that seeks investment return that corresponds (before fees and expenses) to the performance of Nifty Free Float Midcap 100 Index, subject to tracking error.

The Scheme will invest in the securities which are constituents of Nifty Free Float Midcap 100 Index in the same proportion as in the Index.

What is Nifty Free Float Midcap 100 Index?

Nifty Free Float Midcap 100 Index is formulated by India Index Services & Products Limited (IISL), a joint venture between NSE and CRISIL Ltd. It comprises 100 Free Float Midcap stocks with their weightage in index being determined based on their free float market capitalisation.

The primary objective of the Nifty Free Float Midcap 100 Index is to capture the movement and be a benchmark of the Midcap segment of the market.

How is the price of MOSt Shares Midcap 100 determined?

What is minimum investment amount in MOSt Shares Midcap 100 ?

What are ETFs?

What is MOSt Shares NASDAQ 100?

What is NASDAQ-100 Index?

What is NASDAQ?

How is the price of MOSt Shares NASDAQ 100 determined?

What is index investing?

What is an index fund?

An index fund is a type of mutual fund which constructs its portfolio by tracking the composition of a standard market index such as the Nifty 50 or the Sensex. The fund not only invests in stocks which constitute the benchmark index but also the same proportion.

For example – a rise of 1% in the index will lead to a 1% increase in the fund and vice versa. There are numerous indexes (Nifty50, Nifty 500, Nifty Smallcap 150) and many others.

How does an index fund work?

An index fund is a diversified equity fund delivers returns in line with the index it tracks. For example – a midcap 150 index fund will track the nifty midcap 150 index.

The fund manager simply replicates the portfolio of the index in quantity, stocks and proportion. The fund manager has no discretion over stock selection/ strategy of the mutual fund and so the fund has no fund manager bias.

Who should invest in index funds?

Index funds are suited for passive investors i.e. investors who are looking to build long-term wealth but

- Don’t have time to manage their portfolio

- Want to stay away from constant monitoring and juggling their mutual fund portfolio.

- Are skeptical about active fund manager’s long-term efficiency to generate returns above the benchmark index.

- For an investment horizon of 10+ years – index funds remain the most efficient mutual fund.

Who manages index funds?

Why are index funds popular in other parts of the world?

Popularity of index funds is mainly due to following reasons:

- Index funds are cheap to invest.

- Fees play a big role in long-term investing Index funds do better than most actively managed funds (especially in the long-term)

- Survivorship of active funds is low (on an average only 40% of active funds survive after 10 years in the US)

Why should you not invest in index funds?

Why should you invest in index funds?

- Low Cost: Since index funds are passively managed, the total expense ratio (TER) is very less as compared to the actively managed ones. While an actively managed fund may charge you anything between 1-2% as TER, an index fund would typically charge you between 0.20% and 0.50%. At face value, the cost difference may seem small but in the long run, it can become as large as 15% of net returns.

- Diversification: The biggest benefit of mutual funds is diversification. Holding a basket of stocks is proved to be a lot safer than holding individual securities. An index fund has proved to be more diversified since it does not invest in any particular sector, theme or a strategy. Hence lower risk.

- Minimal Scope for bias: Since the allocation of assets in case of index funds is not at the discretion of the fund manager, there is no scope of making losses due to inefficiency in asset allocation or poor management.

- Choices: Some index funds track broad market indexes (like large-cap, mid-cap etc.). Meanwhile, others track specific sectors or industry groups thus, offering a wide range of choices.

- Tax efficiency: There is little to no churn in investing in an index. Therefore – tax is minimized

- Returns: The average mutual fund typically fails to beat the broad indexes. With this in mind, index funds are a great way to capture broader-market returns.

- Better Risk Management: Index funds enable easier risk management due to the stability of its portfolio and the weights. In addition, it’s clear that a large cap index is less risky/volatile than a small-cap. It may not be clear for other non-index funds.

- Long-term investing: Fund managers change, most active funds underperform and funds close down all the time. Index funds negate all of the above. Therefore, great for investing for 10 years+.

Why is Motilal Oswal launching 4 index funds?

All 4 Index funds are very unique and differ in risk and return category. Our goal is to not go sell these funds individually but to allow investors to choose the ones that match their risk appetite and return expectations.

For example – a risk lover with high return expectations would choose the Motilal Oswal Nifty Small cap 250 Index Fund/ Motilal Oswal Nifty Midcap 150 Index Fund whereas a risk averse investor may choose the Motilal Oswal Nifty 500 Fund.

Which index fund should I invest in?

Motilal Oswal offers 4 index funds- Motilal Oswal Nifty Midcap 150 Index Fund, Motilal Oswal Nifty Smallcap 250 Index Fund, Motilal Oswal Nifty 500 Fund and MO Nifty Bank Index Fund. While deciding where to invest, you must keep following things in mind

- Your risk appetite: How much risk you are willing to take. High returns always come with high risk

- Your return expectations – All our funds are unique and are built to deliver different risk and return combinations.

Can I lose money investing in index funds?

Should I pay attention to independent fund ratings?

What is diversification and how does it help in reducing risk?

Diversification is the process of spreading risk by investing in multiple securities as opposed to a few. The rationale behind diversification is that a portfolio constructed of different kinds of securities will lead to higher long-term returns and lower the risk of buying one or two securities. Benefits of diversification:

- Minimizing risk of loss – if one investment performs poorly over a certain period, other investments may perform better over that same period, reducing the potential losses of your investment portfolio from concentrating all your capital under one type of investment.

- Preserving capital – not all investors are in the accumulation phase of life; some who are close to retirement have goals oriented towards preservation of capital, and diversification can help protect your savings.

- Generating returns – sometimes investments don’t always perform as expected, by diversifying you’re not merely relying upon one source for income.

Why is Motilal Oswal launching index funds and not ETF’s?

Motilal Oswal AMC has been a pioneer in the ETF space. MOAMC launched their first ETF in 2010 and subsequently launched the other two ETF’s. MOAMC is launching Index funds since they are considered efficient and customer centric. Some other benefits over ETFs are:

- No Liquidity problems: The industry is plagued with liquidity issues when it comes to trading ETF’s.

- ETF’s today are mostly bought and sold by institutions who prefer to go directly to the AMC and not the exchange.

- Retail + HNI customers as a result pay a premium to buy an ETF and sell ETFs at a discount. This adds cost and leads to a higher tracking error for the investor.

- Index funds however are directly bought from the AMC who provide daily liquidity.

- Demat Account – All investors wanting to buy an ETF need to open a Demat account and buy the unit on the exchange. Buying an index fund is similar to buying any mutual fund

- Brokerage costs – Investors in ETF’s pay brokerage costs (on buying and selling) in addition to the expense ratio. Brokerage and other trading related costs are embedded in the expense ratio

- Simpler to understand – Index funds are pure passive funds. ETFs however may not be (eg. CPSE ETF). Customers see index funds as natural investment vehicles whereas ETF’s are seen as trading instruments.

- SIP option – Setting SIPs are possible in index funds (not possible in ETF’s).

Why are index funds so cheap?

In order to compensate the managers for their time and expertise for selecting stocks and managing the portfolio, a management fee is charged by active fund managers. Also because of frequent buying and selling of stocks, it leads to increase in trading cost.

Index funds which is passively managed, follows a buy and hold portfolio strategy. Constituents of the portfolio seldom change, so fund manager’s role is minimized. That’s why index funds are cheaper than actively traded funds.

Are all index funds the same?

Index funds are passive mutual funds that track a particular index. There are different types of indices in India-

- Benchmark indices – BSE Sensex and NSE Nifty

- Sectoral indices like BSE Bankex and Nifty Bank

- Market capitalization-based indices like the BSE Smallcap and Nifty Midcap

- Broad-market indices like BSE 100 and Nifty 500

All index funds are not same because different index funds track different indices. But the philosophy behind investing remains the same.

What is tracking error? Why does it happen?

The extent to which the index fund does not track the index properly is known as tracking error. It is the difference between a fund’s portfolio returns and the benchmark index it was designed to track. Low tracking error means a portfolio is closely following its benchmark.

Reasons for occurrence of tracking error-

- Index is a dynamic combination and the constituents change. Till the time the fund manager also adjusts the fund holdings accordingly, there will be tracking error present in the fund.

- Expense ratio of the fund also drags down the overall performance.

What is alpha and beta?

Alpha and beta are two of the most important concepts in investing in mutual funds.

Beta represents market returns or benchmark returns. This index funds are built to deliver beta (market) returns.

Alpha represents the return in excess of beta returns. For example if the market/benchmark delivers 8% whereas a fund manager delivers 10%, alpha is 2%.

Every fund manager’s goal is to provide alpha. If he/she fails to deliver alpha, then investors are better off investing in beta products (index funds).

What is expense ratio?

What is entry/exit load?

- Entry Load: This is a charge or commission given by the investor at the time of the initial stage of investment purchase to the mutual fund company. The entry load is usually deducted from the investment amount, reducing the quantum of investment. In India, entry load is zero.

- Exit Load: Exit load in a mutual fund is a charge paid by the investors for selling mutual fund shares before the fixed time period. The commission is a percentage of the share’s value that is being sold. The return earned on selling the investment is reduced as the exit load is charged from the NAV. Exit load is different for different schemes.

Why do Motilal Oswal index funds have an exit load?

MO index funds are open ended funds, whereby investors have the choice to exit the investment plan anytime. However – we at Motilal Oswal believe index funds are great for long-term investing and therefore want to attract investors who want to buy them from a long-term perspective.

In addition – trading (buying and selling securities) incurs transaction costs which are shared by all investors. We want to limit trading and hence have an exit load (up to 3 months).

How does a direct and regular plan work?

All mutual fund schemes offer two plans- Direct and Regular. In a Direct Plan, an investor has to invest directly with the AMC, with no distributor to facilitate the transaction and no investment advice.

In a Regular Plan, the investor invests through an intermediary such as distributor, broker or banker who does all the market research, gives investment advice and is paid a distribution fee by the AMC, which is charged to the plan.

Therefore, the direct plan has a lower expense ratio as there is no distribution fee involved, while the regular plan has a slightly higher expense ratio to account for the commission paid to a distributor to facilitate the transaction.

Why SIP is a great way to invest?

Benefits of investing in a SIP-

- Convenience: You can invest in a disciplined and phased manner using SIP. It allows you the convenience of starting your investment with as low as Rs. 500.

- Cost Averaging: With SIPs- there is no need to time the market. By investing in SIP you buy shares when prices are low and also when prices are high. This reduces your overall cost of investment.

- Power of Compounding: The basic principle of compound interest implies that small amounts invested over a long period of time would result in a larger return compared to a one-time investment.

- Become a disciplined investor: An SIP investment would make you more disciplined in matters of managing your finances. With the option of automated payments, it means you don’t have to remember every month.

What is KYC?

Who is considered a ‘beneficial owner’?

When is KYC done?

Why is KYC compulsory?

What are the benefits of KYC?

Can intermediaries seek additional KYC information?

What is Part I and Part II of the account opening form (AOF)?

Client needs to fill the account opening form at the time of commencement of an account based relationship. Part I of the AOF is the KYC form in which the basic details about the client is captured.

Part II of the form pertains to the additional KYC information as may be sought separately by the financial intermediary such as asset management company, stock broker, depository participant opening the client’s account.

Is there a uniform KYC form to be used for account opening?

What are the different modes of KYC verification available to clients?

Is Permanent Account Number (PAN) card considered as an identity proof for the purpose of KYC?

Is it mandatory to provide PAN details, if it is not considered as proof of identity?

Is PAN-Aadhaar seeding mandatory for transactions in securities market?

No. The Indian government has made it mandatory for everyone to link their PAN to their Aadhaar, with certain exceptions for NRIs, non-citizens, those over 80, and residents of the states of Assam, Jammu and Kashmir and Meghalaya.

Clients in whose case, PAN Aadhaar linkage are not found to be verified, shall be allowed to transact with the existing intermediary subject to valid PAN, however the client’s KYC shall not be allowed portability in securities market.

A client has recently completed PAN-Aadhaar seeding. What is the next step?

What is the difference between masked and unmasked Aadhaar?

What is meant by OVD?

Which documents are acceptable as Proof of Identity (PoI) and Proof of Address (PoA)?

The following documents are acceptable as PoI and PoA:

i. the passport;

ii. the driving licence;

iii. proof of possession of Aadhaar number;

iv. the Voter's Identity Card issued by Election Commission of India;

v. job card issued by NREGA duly signed by an officer of the State Government;

vi. the letter issued by the National Population Register containing details of name address; or

vii. any other document as notified by the Central Government in consultation with the Regulator.

Which documents are acceptable as deemed OVD for POA?

In case the document furnished by the client does not contain updated address, the following documents (or their equivalent e-documents thereof) are acceptable for the limited purpose of proof of address, provided that the client submits updated officially valid document (or their equivalent e-documents thereof) with current address within a period of three months of submitting the following documents:

i. utility bill which is not more than two months old of any service provider (electricity, telephone, post-paid mobile phone, piped gas, water bill);

ii. property or municipal tax receipt;

iii. pension or family pension payment orders (PPOs) issued to retired employees by Government Departments or Public Sector Undertakings, if they contain the address;

iv. letter of allotment of accommodation from employer issued by state or central government departments, statutory or regulatory bodies, public sector undertakings, scheduled commercial banks, financial institutions and listed companies and leave and license agreements with such employers allotting official accommodation.