Don't Time the Market. Take Time in the Market.

An opportunity to invest in

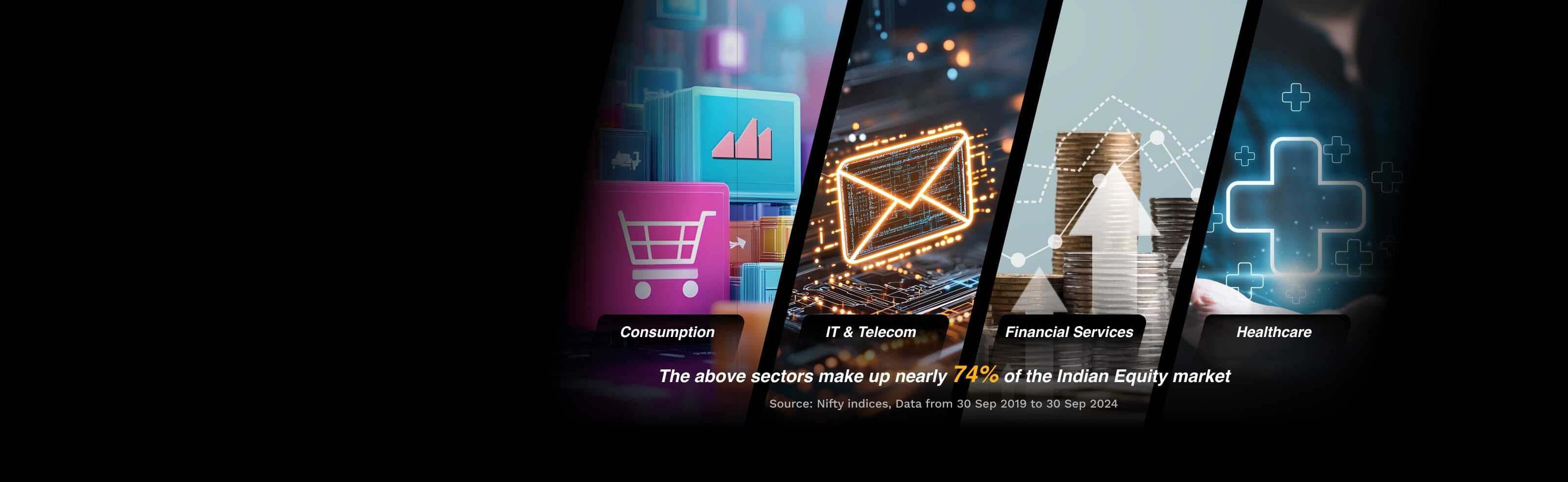

Sectors that matter

About Motilal Oswal MidSmall Sectoral & Thematic Index Funds

Motilal Oswal MidSmall sectoral & thematic index funds offer diversification across key industries & aim to capture a variety of growth opportunities to enhance your portfolio's long-term return potential.

MidSmall Fund Offerings

Motilal Oswal Nifty MidSmall Financial Services Index Fund

NFO₹ 500

Very High

Motilal Oswal Nifty MidSmall IT and Telecom Index Fund

NFO₹ 500

Very High

Motilal Oswal Nifty MidSmall India Consumption Index Fund

NFO₹ 500

Very High

Motilal Oswal Nifty MidSmall Healthcare Index Fund

NFO₹ 500

Very High

About MidSmall Strategies

Nifty MidSmall Financial Services Index

Nifty MidSmall Healthcare Index

Nifty MidSmall IT & Telecom Index

Nifty MidSmall India Consumption Index

Source/Disclaimer: IBEF sector report. The above graph is used to explain the concept and is for illustration purpose only and should not used for development or implementation of an investment strategy. Past performance may or may not be sustained in the future and is not a guarantee of any future returns

Risk & Return profile of Sectors combined vs Nifty 50

| Period | Nifty 50 TRI | MidSmall (Equal Sector Weight) | |

|---|---|---|---|

| Annualized Returns | 1 Year | 33.0% | 47.0% |

| 3 Year | 14.9% | 22.5% | |

| 5 Year | 19.0% | 31.5% | |

| 10 Year | 13.8% | 20.0% | |

| Annualized Volatility | 1 Year | 13.3% | 15.4% |

| 3 Year | 14.2% | 16.1% | |

| 5 Year | 18.9% | 18.3% | |

| 10 Year | 16.5% | 17.0% |

Source/Disclaimer: niftyindices: Performance as of close of 30-Sep-14 to 30-Sep-24. Performance results have many inherent limitations and no representation is being made that any investor will, or is likely to achieve. Past performance may or may not be sustained in future and is not a guarantee of any future return. The above graph is used to explain the concept and is for illustration purpose only and should not used for development or implementation of an investment strategy. TRI= Total Return Index

FAQs

What is the Nifty MidSmall Healthcare Index Fund?

The Nifty MidSmall Healthcare Index Fund is a mutual fund that aims to provide returns that correspond to the performance of the Nifty MidSmall Healthcare Index. The index tracks the performance of mid-cap and small-cap companies in the Indian healthcare sector, including pharmaceuticals, biotechnology, healthcare services, and medical devices.

What is the Nifty MidSmall Financial Services Index Fund?

The Nifty MidSmall Financial Services Index Fund is a mutual fund that aims to track the performance of the Nifty MidSmall Financial Services Index, which comprises mid-cap and small-cap companies in the financial services sector.

What is the Nifty MidSmall India Consumption Index Fund?

The Nifty MidSmall India Consumption Index Fund is an exchange-traded fund (ETF) that aims to replicate the performance of the Nifty MidSmall India Consumption Index. This index represents a diversified portfolio of mid-cap and small-cap companies involved in the consumption sectors, such as consumer goods, retail, and other industries driven by domestic demand.