Don't Time the Market. Take Time in the Market.

Compare Portfolio

Compare Your Portfolio

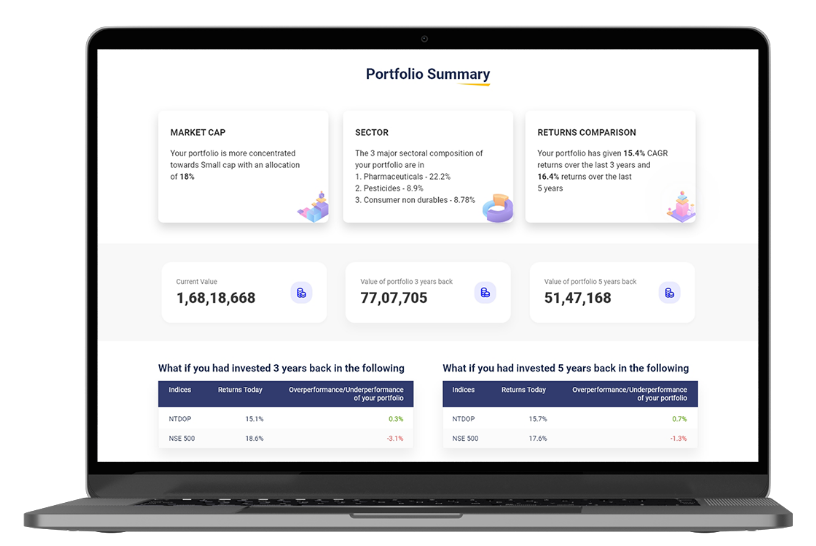

We thank you for your interest in using Motilal Oswal AMC’s Compare Your Portfolio Tool. This tool helps in understanding details about your portfolio. You can compare your portfolio's performance to various funds of Motilal Oswal AMC.

The above image only for illustration purpose only and should not be used for development or implementation of an investment strategy.

There are 2 ways to use this tool

Bulk Upload

Enter the security details in the template with ISIN and Quantity being the mandatory fields. Please download the sample file

Manual Update

Type the name of the security in your portfolio along with the quantities held. You may select the security from the dropdown list.

| Sr. No. | Company | No. of Shares | Action |

|---|

Nifty 500

Compare Your Portfolio

The information entered will not be stored anywhere.

| Sr. No. | Company | No. of Shares | Action |

|---|

Nifty 500