Don't Time the Market. Take Time in the Market.

What are factors & how do they work?

A factor is any characteristic that helps explain the long term risk and return performance of an asset. Factors funds establish a set of rules to help select a portfolio of companies. The rules for a particular factor fund are defined by certain descriptors, for example 6M / 12M Price return for the Momentum factor. Factor funds apply these rules periodically to create an optimized portfolio of stocks, eliminating all ambiguity.

Select A factor fund of your choice

Compare Funds

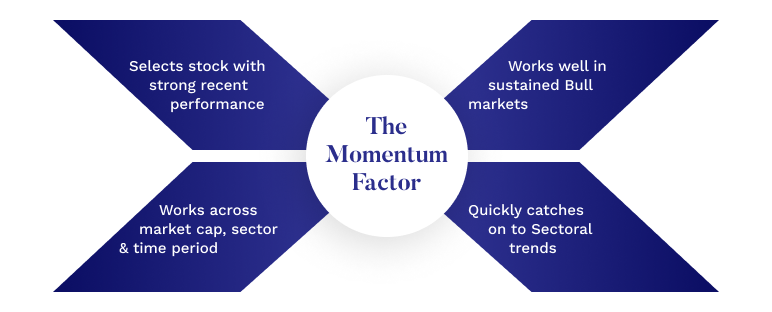

The Momentum Factor

The Low Volatility Factor

The Quality Factor

The Value Factor

The Momentum factor exploits the tendency of winning stocks to continue performing well in the near term

Measured using: 6M Return, 12M Return

15 Year Index Compound annual growth rate

Source/Disclaimer: MOAMC Research; Data as of 30-November-2024. The information / data herein alone is not sufficient and should not be used for implementation of an investment strategy. The table/cha... Read more

FAQs

What are Factor-Based Mutual Funds (Smart Beta Funds)?

Factor-based mutual funds, also known as Smart Beta Funds, use specific factors—like value, quality, momentum, or low volatility—to select stocks. These factors help enhance returns and manage risk through systematic, rule-based strategies.

How do Smart Beta Funds differ from traditional mutual funds?

Unlike traditional mutual funds that are purely active or market-cap-based, Smart Beta Funds combine the best of active and passive strategies. They use pre-defined factors to select stocks, offering a cost-efficient way to optimize returns.

What factors are commonly used in Smart Beta Funds

Some key factors used in Smart Beta Funds include:

- Value: Stocks trading below their intrinsic value.

- Quality: Financially strong companies with robust fundamentals.

- Momentum: Stocks with consistent upward price movements.

- Low Volatility: Stocks with stable price patterns, reducing sharp swings.