Cycles change. Leadership shifts.

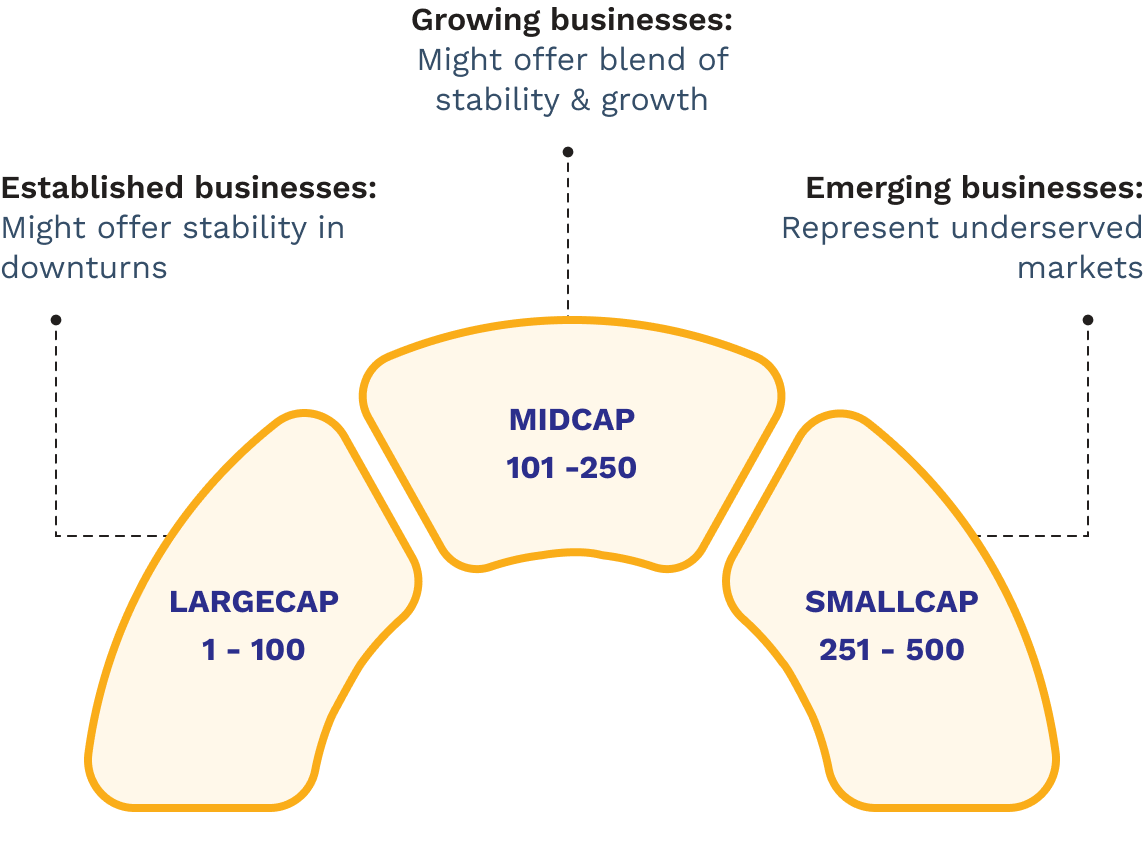

Market growth is influenced by large caps, mid caps, & small caps; each contributing differently. But no segment leads forever. Market leadership rotates across cycles, and timing these can be challenging.

What if you could stay equally invested?

Rather than favouring one segment, what if you could choose a disciplined equal-weight approach instead. So you can aim to capture market-cap rotation, without prediction or timing.

Source/Disclaimer : MOAMC. This information is for general purposes only and is not an offer, recommendation, or solicitation to invest. The characteristics described are for informational purposes an... Read more

Unpacking the NFO

Learn about Motilal Oswal Diversified Equity Flexicap Passive Fund of Funds and how the flexicap-style approach works through a passive, index-based structure.

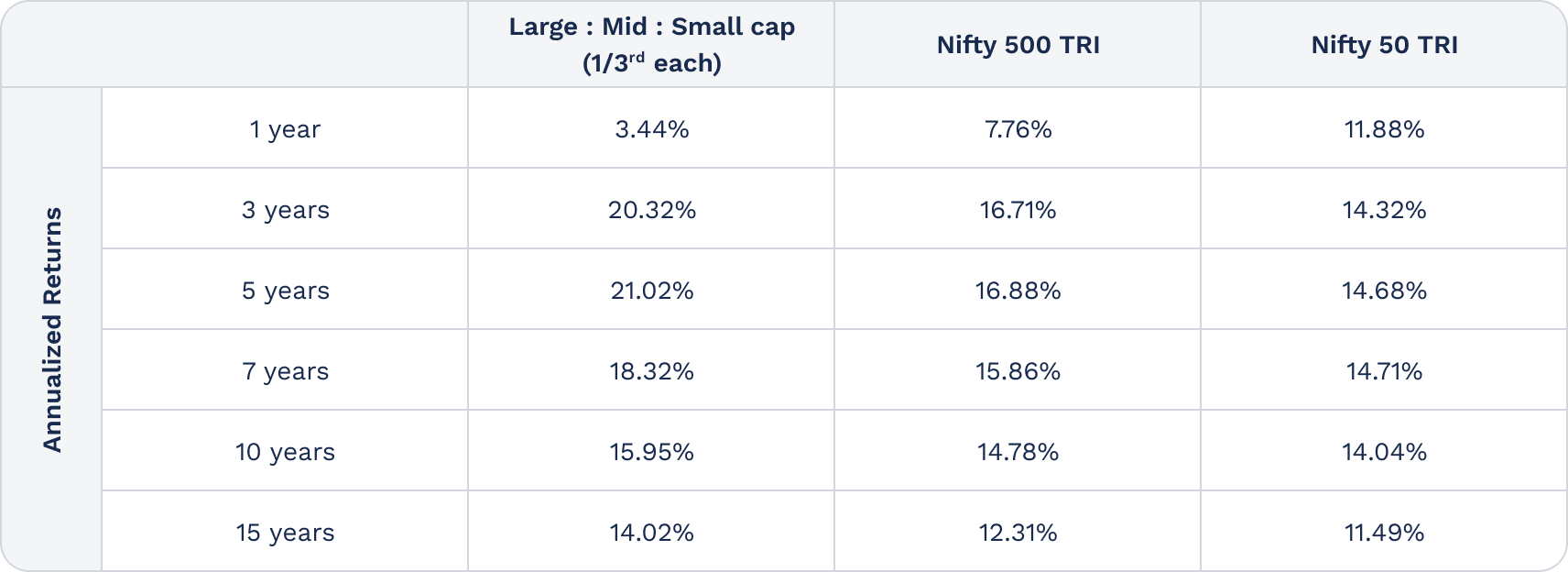

Performance Delivered

The strategy has delivered performance over long term

Source/Disclaimer: NSE; All performance data in INR. Data as of close of 30-Nov-2010 – 30-Nov-2025; Hypothetical performance results may have many inherent limitations and no representation is being m... Read more

Fund Name

Plans

Benchmark

Minimum Application Amount

Minimum Redemption Amount

Investment Objective

The investment objective of the scheme is to generate long term growth/capital appreciation by predominantly investing in passive funds such as ETFs/Index Funds of equity and equity related instruments that offers diversified exposure across all market capitalization segments.

However, there can be no assurance or guarantee that the investment objective of the Scheme would be achieved.

Type

Entry load

Exit load

1%- If redeemed on or before 15 days from the date of allotment.

Nil- If redeemed after 15 days from the date of allotment.

Fund Managers

FAQs

What is Motilal Oswal Diversified Equity Flexicap Passive Fund of Funds?

Why is this fund called a Flexicap Fund?

The fund’s investment across large, mid, and small caps is not fixed at all times. The weights are allowed to move with market performance within set limits providing flexibility across market caps in a disciplined manner.

Does the fund try to predict market-cap rotations?

No. The fund does not attempt to predict which segment will outperform next. Instead, it seeks to participate in market-cap rotations through its structured allocation and rebalancing process.