What are Financial Services?

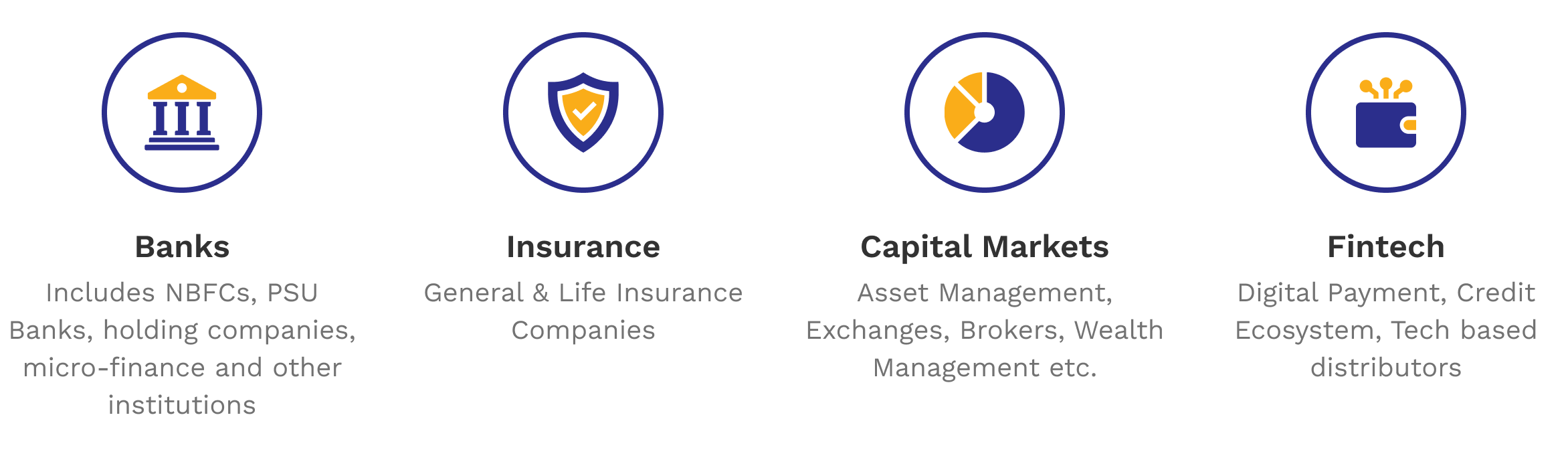

Financial Services are ecosystem that help people and businesses manage, grow and protect their money.

Source: Motilal Oswal Internal. The sector mentioned herein are for general assessment purpose only and not a complete disclosure of every material fact. It should not be construed as investment advic... Read more

Why Motilal Oswal Financial Services Fund?

Source: MOAMC Internal. The information presented is for informational purposes only. The portfolio composition is indicative and does not constitute a recommendation.*As per current Fund management S... Read more

Unpacking the NFO

Learn about Motilal Oswal Financial Services Fund

Fund Name

Plans

Benchmark

Minimum Application Amount

Minimum Redemption Amount

Investment Objective

The primary objective of the Scheme is to generate long-term capital appreciation by investing in equity or equity related instruments across market capitalization of companies deriving majority of their income from financial Services businesses.

However, there is no assurance that the investment objective of the scheme will be realized.

Type

Entry load

Exit load

1% - If redeemed within 90 days from the day of allotment.

Nil - If redeemed after 90 days from the date of allotment.

Fund Managers

FAQs

What is the investment objective of Motilal Oswal Financial Services Fund?

The primary objective of the Scheme is to generate long-term capital appreciation by investing in equity or equity related instruments across market capitalization of companies deriving majority of their income from financial Services businesses.

However, there is no assurance that the investment objective of the scheme will be realized.

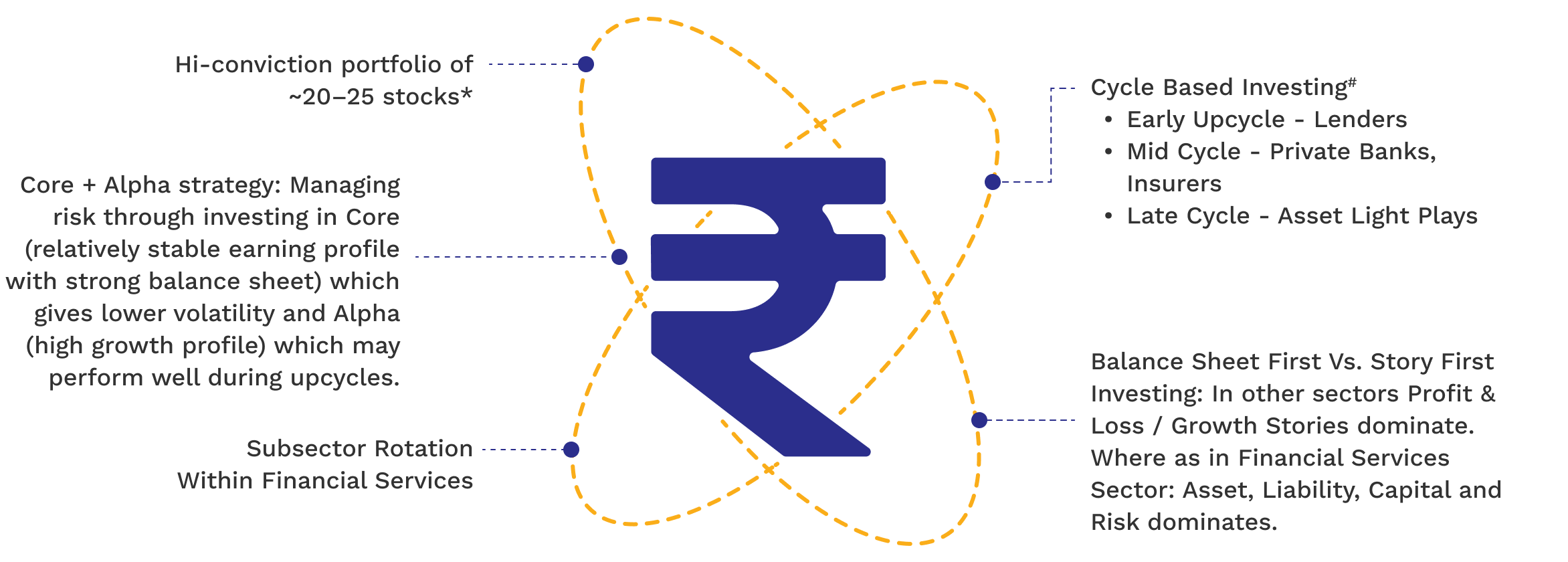

What is the strategy behind Motilal Oswal Financial Services Fund (NFO)?

The scheme aims to generate long-term capital appreciation by investing in companies across the financial services spectrum, including in Financial Services business comprising of banks, insurance providers, asset management firms, Credit Rating Agencies, Clearing Houses and Other Intermediaries, Financial Technology (Fintech), Exchanges and Data Platforms, Investment Banking Companies, Wealth Management Entities and Distributors of Financial Products.

The scheme may invest upto 20% of its total assets in equities and equity related securities of other than financial NFO SID of Motilal Oswal Financial Services Fund services. Through an actively managed, high-conviction approach combining top-down sector analysis with bottom-up stock selection and top-down approach.

Who is the Fund Manager of Motilal Oswal Financial Services Fund?

Mr. Ajay Khandelwal (Fund Manager –Equity Component), Mr. Atul Mehra (Fund Manager –Equity Component), Mr. Sandeep Jain (Fund Manager –Equity Component), Mr. Bhalchandra Shinde (Associate Fund Manager - Equity Component), Mr. Rakesh Shetty (Fund Manager –Debt Component) & Mr. Swapnil Mayekar (Fund Manager- Foreign Securities).