What are factors?

Factors are the key drivers that determine a stock's long-term returns and risk characteristics

Note: The selection of factors/strategy shall be at the discretion of the Fund Manager, in accordance with the Scheme’s investment objective as per SID. Source: MOAMC Internal. Disclaimer: The illustr... Read more

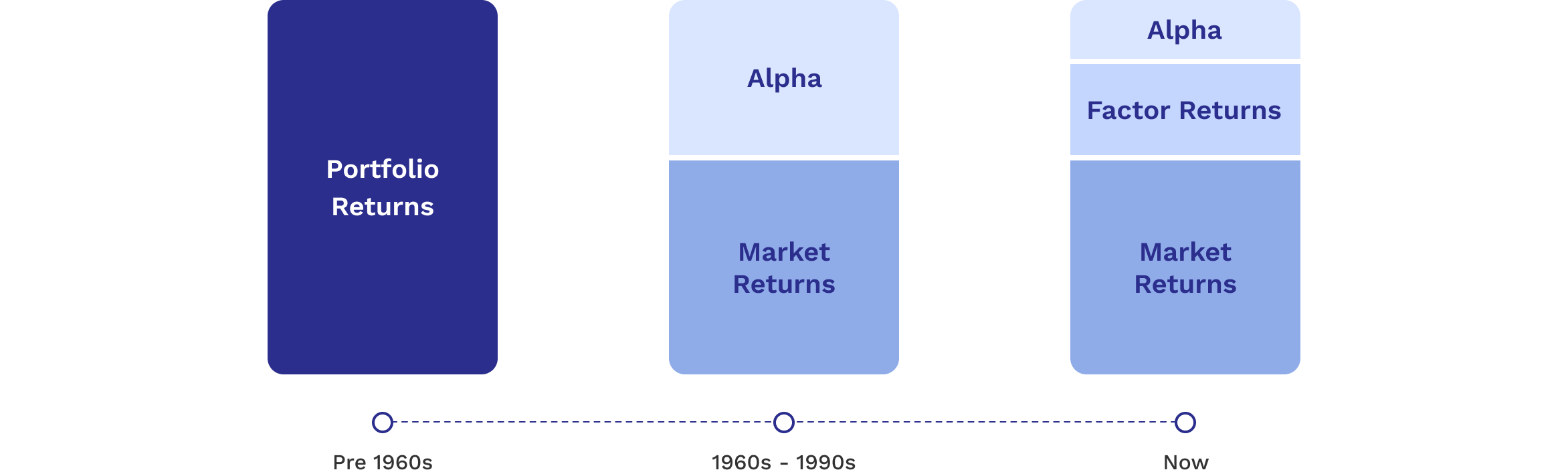

Why Factors Matter?

Factor analysis helps identify what drives your alpha – moving beyond traditional performance metrics to systematic, explainable sources of return.

Source/Disclaimer: The above information / data is used to explain the concept and is for illustration purpose only

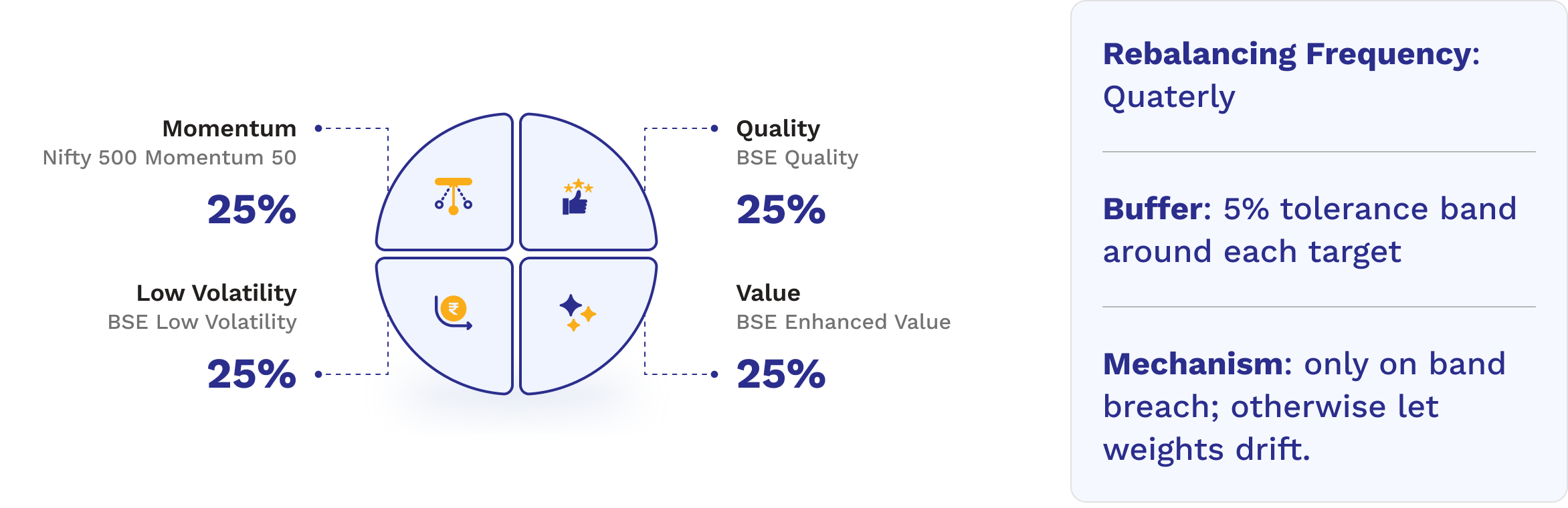

Methodology of the Fund

Note: The selection of factors/strategy shall be at the discretion of the Fund Manager, in accordance with the Scheme’s investment objective as per SID. Source: NSE, BSE. Scheme would invest in Index ... Read more

Fund Name

Plans

Benchmark

Minimum Application Amount

Date of Allotment

Investment Objective

The investment objective of the scheme is to generate returns by offering multi factor investment solution that predominantly invests in units of passively managed factor based ETFs and/or Index Funds.

However, there can be no assurance or guarantee that the investment objective of the Scheme would be achieved.

Type

Taxation

Long-term Capital Gains– 12.5% on gains above ₹1.25 lakh (held for more than 12 months)

Short-term Capital Gains– 20% (held for up-to 12 months)

Tax treatment of mutual funds is subject to change. The tax information provided is for general informational purposes only and is not intended as tax advice. Investors are advised to consult their tax advisor before making any investment decisions and tax advice.

Entry load

Exit load

1% If redeemed on or before 15 days from the date of allotment

Nil - If redeemed after 15 days from the date of allotment

Fund Managers

FAQs

What is Motilal Oswal Multi Factor Passive Fund of Funds?

It is an open-ended Fund of Funds scheme investing in units of passively managed factor-based ETFs and Index Funds. The fund aims to generate long-term capital appreciation through a rules-based multi-factor approach.

How is this fund different from a regular equity fund?

Unlike actively managed funds that rely on fund manager discretion, this fund follows a systematic, rules-based approach by investing equally across four proven factors—Momentum, Quality, Low Volatility, and Value—through passive index funds and ETFs.

What problem does this fund aim to solve for investors?

Investors often struggle with deciding which factor will outperform and when. Factor leadership keeps rotating across market cycles, making timing difficult. This fund removes that guesswork by maintaining equal exposure to all four factors at all times.