Index SIP Returns

Source/Disclaimer: www.niftyindices.com; Performance Data as of close of 01-Jul-2015 – 30-Jun-2025; All performance data in INR. Hypothetical performance results may have many inherent limitations and... Read more

What are MidCaps?

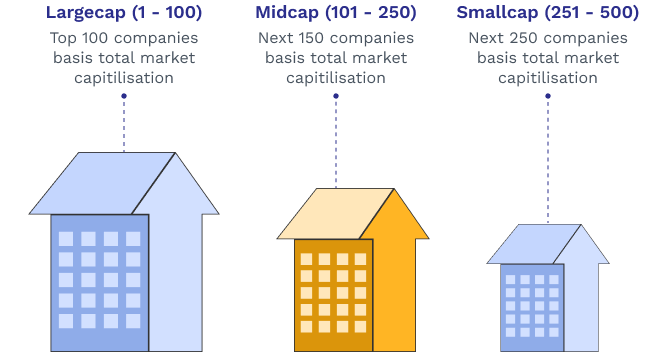

Midcaps are the 150 companies ranked after the Nifty 100 by market cap (as per NSE). They represent a sizable slice of India’s listed market, with proven models, growing presence, and strong potential to become future large caps across diverse sectors.

Source/Disclaimer: www.niftyindices.com, Data as of close of 28-Mar-2025; For detailed index methodology kindly visit www.niftyindices.com. The above data/graph is used to explain the concept and is f... Read more

Why Invest in this Fund?

Fund Name

Plans

Benchmark

Minimum Application Amount

Minimum Redemption Amount

Investment Objective

The Scheme seeks investment return that corresponds to the performance of Nifty Midcap 150 Index subject to tracking error.

However, there can be no assurance or guarantee that the investment objective of the Scheme would be achieved.

Type

Entry load

NIL

Exit load

1% - If redeemed on or before 15 days from the date of allotment. Nil - If redeemed after 15 days from the date of allotment.

Fund Managers