When you invest in mutual funds, you place your money in a fund managed by pros who own a pool of securities like bonds, stocks, and others. Investing may sometimes give you earnings, and you might also have to pay taxes on these gains. The policy of taxation on mutual funds is determined by the government, and depending on the factors that differ for various funds, for example, the type of fund and the length of holding of the investment.

What is Tax on Mutual Funds?

When you invest in mutual funds, you’re essentially buying a small part of a bigger investment portfolio. This means that when the value of the investments in the mutual fund goes up, your investment also becomes more valuable. When you sell your mutual fund units for a profit, you may have to pay taxes on the gains you’ve made. These taxes are called capital gains taxes, and they can be different for short-term gains (when you sell your units within three years) and long-term gains (when you sell them after three years).

Factors to Determine Tax on Mutual Funds

The tax calculated on the mutual fund investments depends on the various factors outlined below. Another aspect of that is the kind of mutual fund that you have invested. Equity funds cater mainly for stocks and taxed differently from debt funds which invest in fixed-interest securities like bonds. The third factor is most probably the time that you’ve held the investment. For debt funds, holding an investment for more than 36 months then typically incurs a higher tax rate on gains compared to longer holding periods. (For equity funds, the holding period is 12 months.)

How Do You Earn Returns in Mutual Funds?

When you invest in mutual funds, you earn returns in two main ways: capital appreciation and dividend payments.

- The capital gains occur when the value of shares in the mutual fund grow during the period.

- Dividends are termed payments made by a company to its shareholders, and when you buy a mutual fund that includes dividend paying stocks, you get a share proportional to the amount of those dividends.

Taxation of Dividends Offered by Mutual Funds

- Dividends received from mutual funds are also subject to taxes. The mutual fund company deducts a dividend distribution tax (DDT) before distributing the dividends to investors. The rate of DDT can vary depending on the type of mutual fund and the nature of the dividends.

- Long-term capital gains (LTCG) refer to the profit earned from an asset held for an extended period, while short-term capital gains (STCG) are profits from assets held for a shorter duration.

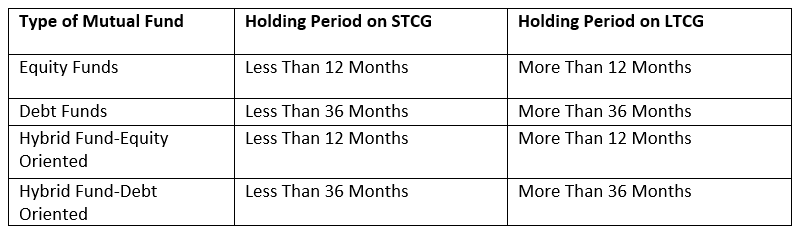

The definition of “long” and “short” varies between equity and debt schemes concerning taxation. For mutual funds, to qualify as long-term capital gains, the holding period must be at least 12 months for equity-oriented schemes and 36 months for debt-oriented schemes. The table below summarizes the holding periods required for capital gains to be classified as long-term or short-term.

Taxation of Capital Gains Offered by Mutual Funds

When you sell the units of your mutual fund for a profit, you will need to pay for the taxes on the capital gains. For debt funds, gains from units held for less than 36 months they are considered short-term and taxed at a higher rate, while those held for longer are classified as long-term gains and taxed at a lower rate. (For equity funds, the holding period is 12 months)

Taxation of Capital Gains of Equity Funds

Equity funds are essentially characterised by investing in stocks mostly. When you are realising profit by selling the units of your mutual fund, the capital gain obtained from the transactions are treated as taxable. Keep in mind that the tax rate varies depending on whether you have held investments for long. If your investment held for more than one year, you have to pay little tax on your realized gains.

Taxation of Capital Gains of Debt Funds

Debt funds are the go-to instruments for investors that invest primarily in fixed-income securities such as bonds. On realization of your profit by selling your debt mutual fund units, capital gains you make would get taxed. The tax rate depends on how you hold your investments. The time you’ve held your investments determines the tax rate. If you have left your investments in a portfolio for over three years, there is a good chance you can enjoy a lower tax rate for your capital gains.

Taxation of Capital Gains of Hybrid Fund

Hybrid funds invest in a combination of stocks and bonds. When you sell your hybrid mutual fund units for a profit, the gains you incur are taxable. The tax rate is determined by the period during which you have held your investments Taxation of capital gains from hybrid funds depends on whether they are classified as equity-oriented (held for over 12 months) or debt-oriented (held for over 36 months), affecting the applicable tax rate on profits from selling fund units, which is lower for longer holding periods compared to ordinary income tax rates.

Taxation of Capital Gains When Invested Through SIPs

Systematic Investment Plans (SIPs) are a great way for you to invest a small sum of money in mutual funds on a fixed basis. The SIP tax is contingent on how long you have invested. Long-term capital gains are your profit for investing for more than a year and they are taxed at a lower rate. If you have been investing for not more than a year, the short-term capital profit you make is considered a high tax rate.

Securities Transaction Tax (STT)

When you buy or sell mutual fund units, you may have to pay a tax called Securities Transaction Tax (STT). This tax is levied by the government and is calculated as a percentage of the transaction value. STT is applicable to both equity and debt mutual funds.

Declaring Mutual Fund Investments in ITR

While you are filling your Income Tax Return (ITR), you must report your mutual fund investments. It also includes finer points such as the name of the mutual fund, the amount invested, and the gains/losses. A failure to declare your investment portfolio may result in penalties, so it is advisable to truthfully reveal your mutual fund investments in the income tax return.

Conclusion

Investing in mutual funds can be a great way to grow your money. However, it’s important to understand the tax implications of your investments. By knowing how mutual funds are taxed, you can make informed decisions and maximize your returns.

FAQ’s

1. Are mutual funds taxable?

Yes, mutual funds are taxable based on the gains earned from them.

2.What is the tax on mutual funds?

The tax on mutual funds is determined by factors such as the type of fund and the holding period of the investment.

3.How are capital gains from mutual funds taxed?

Capital gains from mutual funds are taxed based on the holding period of the investment.

4.Do SIPs have tax implications?

Yes, SIPs have tax implications based on the holding period of each SIP installment.

5.What are the factors that determine the tax on mutual funds?

The tax on mutual funds depends on factors such as the type of mutual fund (equity or debt), the holding period of the investment, and the nature of the gains (short-term or long-term).

6.Are dividends from mutual funds taxable?

Yes, dividends received from mutual funds are subject to tax. The tax rate depends on the type of mutual fund and the nature of the dividends.

7.What is dividend distribution tax (DDT)?

Dividend distribution tax (DDT) is the tax deducted by the mutual fund before distributing dividends to investors. It is applicable to dividends offered by mutual funds.

8.How do I declare my mutual fund investments in my income tax return (ITR)?

You need to declare your mutual fund investments in the capital gains section of your ITR. Provide details such as the name of the mutual fund, the amount invested, and the gains or losses incurred.

9.Can I reduce my tax liability on mutual funds?

Yes, you can reduce your tax liability on mutual funds by holding onto your investments for the long term, as long-term capital gains are taxed at a lower rate than short-term gains.

10.Are there any tax-saving mutual funds available?

Yes, there are tax-saving mutual funds, also known as Equity Linked Savings Schemes (ELSS), which offer tax benefits under Section 80C of the Income Tax Act.

11.Is there a tax on mutual fund transactions?

Yes, there is a tax called Securities Transaction Tax (STT) that is applicable on the purchase and sale of mutual fund units.

12.Can I offset losses from mutual funds against gains from other investments?

Yes, you can offset losses from mutual funds against gains from other investments to reduce your overall tax liability.

13.What happens if I do not pay tax on my mutual fund gains?

Failure to pay tax on your mutual fund gains can lead to penalties and legal consequences. It’s important to accurately report your gains and pay the applicable taxes.

Disclaimer: This publication is pursuant to Investor Education and Awareness Initiative by Motilal Oswal Mutual Fund. This shall not be construed as offer to invest in any financial product or Scheme. The objective of this publication is restricted to informational purposes only. All investors have to go through a one-time KYC (Know Your Customer) process. For further details on KYC, Change of address, phone number, bank details etc. list of SEBI registered Mutual Funds and redressal of complaints including details about SEBI SCORES portal, visit link https://www.motilaloswalmf.com//New_Page/KYC-and-Redressal-of Complaints/9, SMART ODR portal, visit link https://smartodr.in/login. Investors should invest only with SEBI registered Mutual Funds details of which can be verified on the SEBI website under “SEBI Intermediaries/ Market Infrastructure Institutions.” This has been issued on the basis of internal data, publicly available information and other sources believed to be reliable. The information contained in this document is for general purposes only and not a complete disclosure of every material fact. The information/data herein alone is not sufficient and shouldn’t be used for the development or implementation of an investment strategy. It should not be construed as investment advice to any party the blog does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Mutual Funds are subject to market risk. Read the offer documents before investing. Readers shall be fully responsible/liable for any investment decision taken on the basis of this article.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.